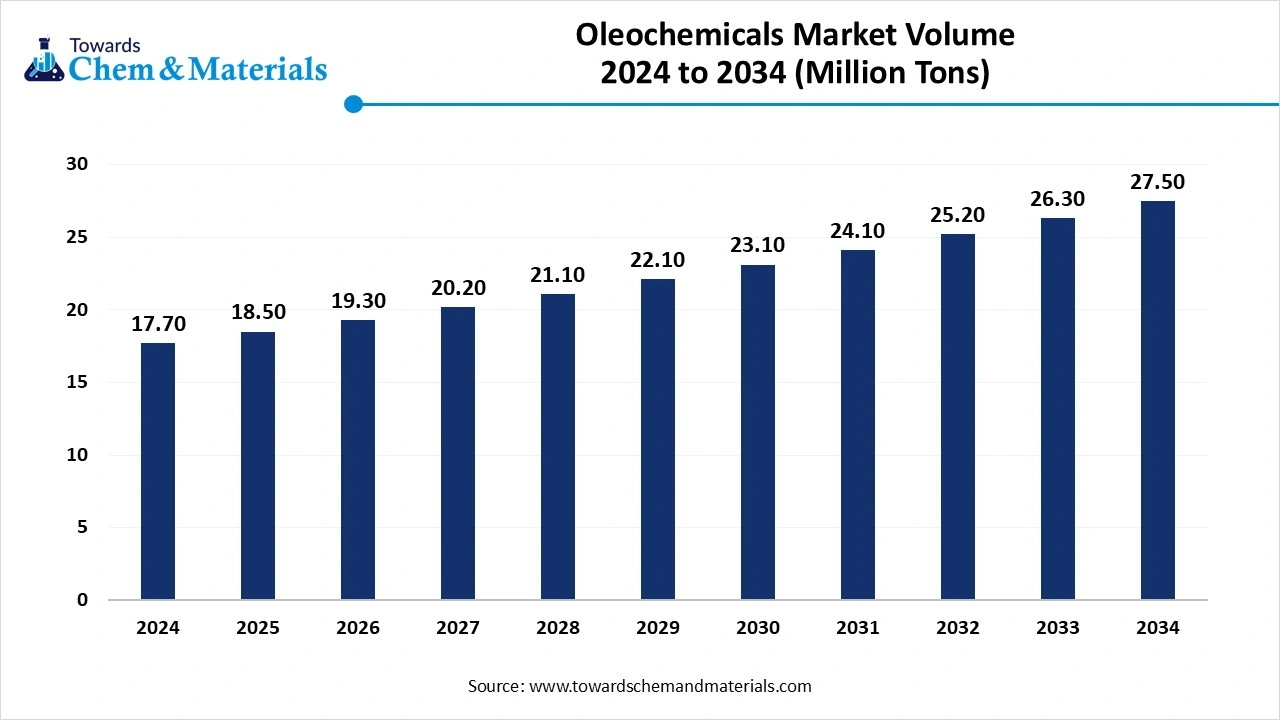

Ottawa, July 11, 2025 (GLOBE NEWSWIRE) — The global oleochemicals market volume was valued at 17.70 million tons in 2024 and is predicted to hit around 27.50 million tons by 2034, Asia Pacific dominated the Oleochemicals market with a market volume share of 41.9% in 2024. a study published by Towards chem and Materials a sister firm of Precedence Research.

The growth of food and beverage industry is helping to drive the oleochemicals industry. Food and beverage manufacturers are using food-grade emulsifiers, release agents, and stabilizers that all rely on oleochemicals to produce these materials.

Get All the Details in Our Solutions –Download Sample: https://www.towardschemandmaterials.com/download-sample/5537

Oleochemicals Market Highlights

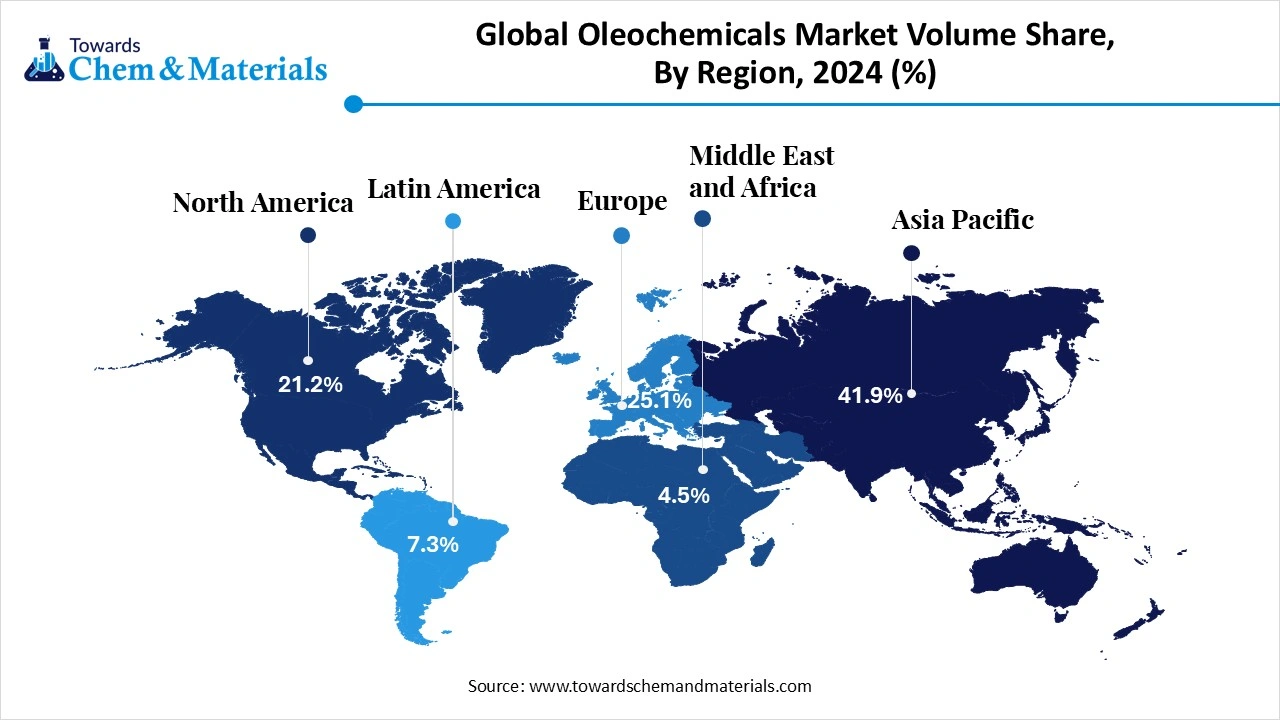

- Asia Pacific Oleochemicals market dominated the global industry with a Volume share of 39.69% in 2024.

- The North America is anticipated to experience the fastest growth rate during the forecast period, akin to sudden shift toward sustainable alternatives.

- The Europe has held Volume share of around 25.1% in 2024.

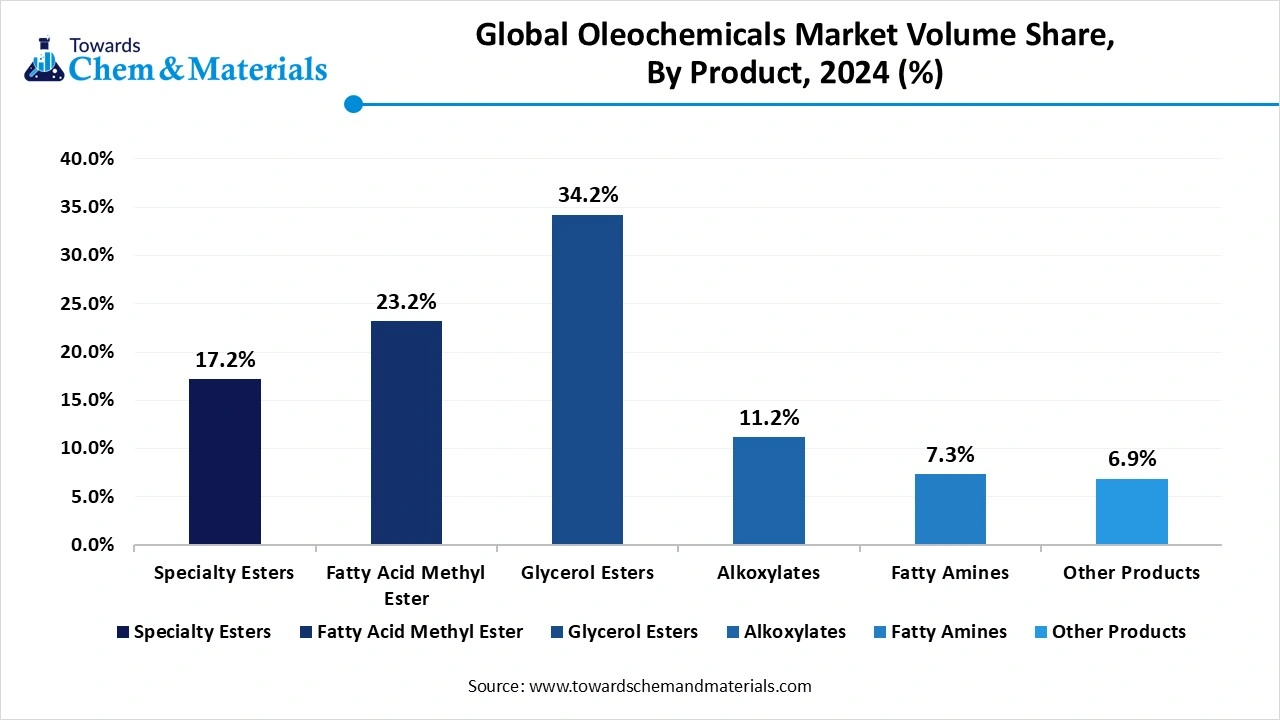

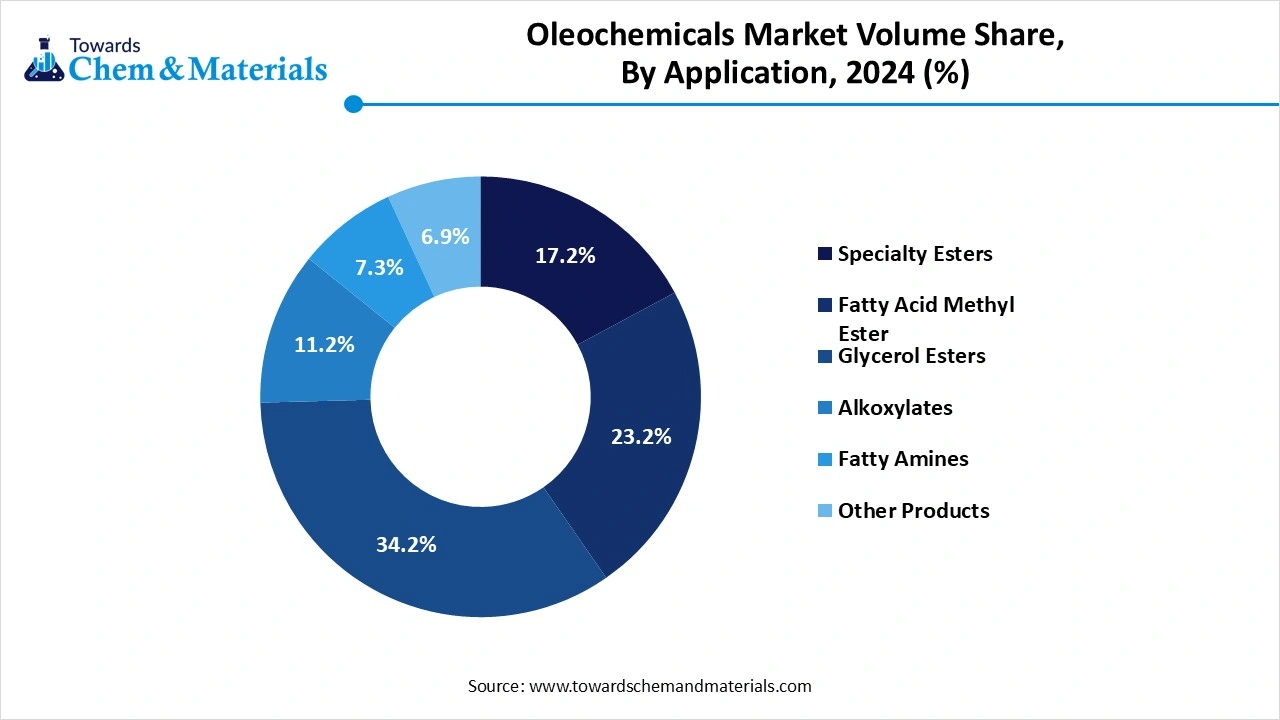

- By Product, the glycerol esters segment held a dominant position in the market, capturing more than a 34.2% Volume share.

- By Product, the specialty esters segment is expected to experience significant market growth in the future, owing to its biodegradability and performance excellence.

- By application, the personal care & cosmetics segment held a dominant market position in 2024, accounting for more than 30.1% of the market Volume share.

- By application, the industrial segment is expected to grow at the fastest rate in the market during the forecast period, owing to factors such as rapid commercialization and others.

Market Overview

Oleochemicals are natural fats and oils that are derived from organic (animal and vegetable) sources and offer a more suitable and renewable replacement to petrochemicals. The market covers products such as fatty acids, fatty alcohols, glycerol, and esters that are used in the personal care, food, pharmaceuticals, and industrial markets. The market has been growing due to the increasing demand for renewable, biodegradable, and non-toxic chemical ingredients, combined with increasing environmental regulations.

Increased adoption in bio-lubricants, surfactants, and green solvents continue to increase the foothold of this industries product. Furthermore, the increasing push for sustainable and renewable sources for consumer products to replace traditional virgin and recycled sources is increasing the growth of the global market from developed and developing economies.

Oleochemicals Market Report Scope

| Report Attribute | Details |

| Market Volume in 2025 | 18.50 Million Tons |

| Expected Volume by 2034 | 27.50 Million Tons |

| Growth rate | CAGR of 4.50% from 2024 to 2034 |

| Base year for estimation | 2024 |

| Historical data | 2019 – 2024 |

| Forecast period | 2025 – 2034 |

| Quantitative units | Volume in kilotons, revenue in USD million, and CAGR from 2025 to 2035 |

| Report coverage | Volume and revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | Product, application, region |

| Key companies profiled | Vantage Specialty Chemicals, Inc.; Emery Oleochemicals; Evonik Industries AG; Wilmar International Ltd.; Kao Chemicals Global; Ecogreen Oleochemicals; Corbion N.V.; Cargill, Incorporated; Oleon NV; Godrej Industries; IOI Corporation Berhad; KLK OLEO; Evyap; JNJ Oleochemicals, Incorporated; Sakamoto Yakuhin Kogyo Co., Ltd.; Stepan Company; Pepmaco Manufacturing Corporation; Philippine International Dev |

Explore Strategic Figures & Forecasts – Access the Databook | Immediate Delivery Available: https://www.towardschemandmaterials.com/download-databook/5537

Benefits of Palm Oil-Based Oleochemicals

Palm oil presents a significant benefit over other oil crops due to its competitive price, increased efficiency and high productivity. Palm oil is significantly less expensive than soybean oil, and despite the fluctuating nature in price, it is considered the most affordable oil for consumers in low-income countries. Oil palm is able to grow on land deemed less suitable for other crops and still generate commercially viable yields. Palm-oil farms also require less fertilizer, pesticides and energy, which makes it a more eco-friendly choice. Additionally, since they are perennial plants, oil palms have the added benefit of reliability since they are productive year-round. In order for palm oil to be produced in a sustainable manner, there are guidelines set by the Roundtable on Sustainable Palm Oil (RSPO).

What Are Oleochemicals Used For?

Oleochemicals are used in a wide range of industries including:

- Personal care & cosmetics

- Coatings, adhesives, elastomers and sealants

- Household and industrial cleaning

- Lubricants, grease and metalworking

- Food

- Pharmaceuticals and nutraceuticals

What are the Major Trends in the Oleochemicals Market?

- Shift to Bio-based and Sustainability Products Increased environmental concerns and regulatory agency pressures force industries to change from petrochemicals to oleochemicals. Consumers and manufacturers are choosing bio-based raw ingredients for their cosmetics, detergents, and packaging.

- Growth of Green Surfactants and Lubricants Increased demand for plant-based surfactants for home care and industrial cleaners and bio-lubricants for the automotive and machinery industries have opened new possibilities for oleochemical applications, thus creating more investment and innovation.

- Increasing Production and Consumption in Asia-Pacific Countries like Indonesia, Malaysia, and China will become global hubs for oleochemical production due to the large supply of palm oil feedstock and rising domestic consumption, providing the highest growth within the regional and global markets.

Smart AI Reshaping the Oleochemicals Industry

Artificial intelligence is quickly reshaping the medical oleochemicals landscape through smart and sustainable innovation. Recently, large, multinational chemical companies have used AI-driven predictive analytics and process optimization to improve the production of fatty alcohols important bio-based oleochemicals with better yields and less energy. Indian specialty chemical companies report that their net profits nearly doubled in Q2 2024, crediting their growth to the application of AI-enabled automation in their oleochemical lines. Meanwhile, in pharma R&D labs, machine learning is being used to accelerate compound screening, allowing for virtual testing of millions of molecules, improving the success rate from ~50% to ~80%

Together, AI and oleochemicals represent a new and transformative era of climate-smart, bespoke production of medical-grade chemicals.

Growth Factor

Could Biofuel Blending Mandates be Driving the Oleochemicals Market’s Growth?

One contributing factor driving growth for the oleochemicals market is the appetite for biofuel blending mandates around the world. Key regions of the world are implementing legislation requiring a blending percentage of renewable oils into conventional fuels. This creates a higher demand for oleochemical based feedstocks like fatty acids, methyl esters, and glycerin.

- In October 2024, Indonesia implemented B35 mandate (2023), requires biodiesel to be blended at 35% palm oil blend, which translates to close to 6.2 million tonnes of palm oil consumed for energy.

As such, the European Union’s Renewable Energy Directive II (RED II) is now putting rigid emission reduction targets which provide demand for traceable, more pure raw materials. In India, the National biofuels policy, plans to have 20% ethanol blending by 2030, and facilitates biodiesel from non-edible oils and used cooking oil, fortifying the local oleochemical value chain. Hence, biofuel use age is like a cross-sector the oleochemical landscape now stakeholders generate innovation and capital investment across the oleochemical landscape.

Opportunity factor

Can the Green Movement in Biodegradable Oleochemicals Be Your Greatest Potential Opportunity?

With global demand shifting towards ecological chemicals, oleochemicals derived from natural fats and oils are experiencing unprecedented momentum. In just the last month, KLK has commenced operation at its recently expanded China facility with its maximum annual processing capacity of 500,000 t, with a focus on high‑purity fatty acids and glycerin.

Meanwhile, with continued sustainable procurement goals like the U.S. BioPreferred program and green chemical subsidies in the EU accelerating the adoption of oleochemicals. At the same time, innovations in the use of enzymatic and microbial production methods have reduced costs and improved the purity of oleochemicals. In conjunction with these developments, strong regulatory tailwinds, recent capacity expansions, and greener production routes—oleochemicals are well positioned as the biodegradable substitutes to petrochemical ingredients across consumer goods and industrial applications.

Limitations and Challenges in the Oleochemicals Market

- Reliance on Agricultural Feedstock’s- The oleochemical industry is primarily dependent on vegetable oils, such as palm oil, soybean oil, and coconut oil. Climate change, crop yield fluctuations, land availability, and the food vs. fuel narrative can affect supply and push prices up.

- Environmental and Deforestation Considerations- The production of palm oil, one of the main feedstocks for oleochemicals, is associated with large-scale deforestation, biodiversity loss, and greenhouse gas emissions. Increased scrutiny from consumers and manufacturers about sustainability, as well as possible regulations, could constrain sourcing and limit market development, particularly in regions where environmental concerns are at the forefront.

- Competition with Petrochemicals- While oleochemicals is considered environmentally friendly, and readily available, they can offer challenging competition to lower cost, better-established petrochemical alternatives. For certain industries, where costs are tightly controlled, the difference in price between petrochemicals and oleochemicals can be a significant hurdle to overcome.

Oleochemicals Market Segmentation

Product Insights

Which Product Segment is Dominating the Oleochemicals Market?

The glycerol esters segment dominated the market in 2024, with many applications representing a range of uses in food emulsifiers, lubricants, and personal care formulation. The multifunctional properties of Glycerol Esters, especially biodegradability and skin compatibility, further enhance their appropriateness across consumer products. The rising demand for natural products in the cosmetics and food processing industries is positively impacting acceptance & utilization for Glycerol Esters.

Oleochemicals Market Volume Share, By Product, 2024 (%)

| By Product | Market Shares (%) (2024) | Volume (Million Tons) (2024) | |

| Specialty Esters | 17.2 | % | 3.00 |

| Fatty Acid Methyl Ester | 23.2 | % | 4.10 |

| Glycerol Esters | 34.2 | % | 6.10 |

| Alkoxylates | 11.2 | % | 2.00 |

| Fatty Amines | 7.3 | % | 1.30 |

| Other Products | 6.9 | % | 1.20 |

Specialty esters segment expects the fastest growth in the oleochemicals market during the forecast period, and driven primarily by increasing demand for high performance ingredients in the lubricants, personal care and pharmaceutical markets. They possess an excellent degree of oxidative stability and low volatility in skin conditioning formulations. High temperature applications also apply to Specialty Esters, as they have a greater thermal stability relative to Glycerol Esters. Increasing R&D into bio-based & biodegradable lubricants and anti-aging skin care is also a driving force for Specialty Esters usage.

Application Insights

Why is Personal Care & Cosmetics the Leading Application Segment?

The personal care & cosmetics segment will dominate the market in 2024, because of their renewable and biodegradable nature as well as skin compatibility. Fatty-acids, glycerol-esters, and fatty-alcohols that come from natural oils are commonly found in moisturizers, shampoos, soaps, and creams. As consumers become more aware of natural and sustainable beauty product options, cosmetics brands are replacing synthetic chemicals with plant-based and natural products.

Oleochemicals Market Volume Share, By Applications, 2024 (%)

| By Application | Market Shares (%))(2024) | Volume (Million Tons)(2024) | |

| Personal Care & Cosmetics | 30.1 | % | 5.30 |

| Consumer Goods | 15.8 | % | 2.80 |

| Food Processing | 12.8 | % | 2.30 |

| Textiles | 8.1 | % | 1.40 |

| Paints & Inks | 6.7 | % | 1.20 |

| Industrial | 10.1 | % | 1.80 |

| Healthcare & Pharmaceuticals | 8.3 | % | 1.50 |

| Polymer & Plastic Additives | 5.3 | % | 0.90 |

| Other Applications | 2.6 | % | 0.50 |

The industrial segment is expected to grow at the fastest rate in the forecast period, driven by increasing demand for sustainable raw materials in the lubricants, plastics, and surfactants markets. The growing regulatory impetus to promote greener alternatives also enhances industrial demand, especially in metalworking fluids, adhesives, and bioplastics in various manufacturing applications.

What Makes Asia Pacific a Global Oleochemicals Leader?

Asia Pacific dominated the global oleochemicals market in 2024, primarily because it has plentiful natural resources and an established production base. There are abundant resources and significant volumes of palm-based feedstocks that are essential to oleochemicals in China, Indonesia, and Malaysia. Asia Pacific has a mature oleochemical value chain, lower production costs, and solid export-oriented manufacturing strategies. Regions where oleochemicals are utilized, such as personal care, detergents, and biofuels, are all active in increasing capacity and innovating oleochemical products, allowing continued regional dominance.

Oleochemicals Market Volume Share, By Region, 2024 (%)

| By Region | Market Shares (%) | Volume (Million Tons)(2024) | |

| North America | 21.2 | % | 3.70 |

| Europe | 25.1 | % | 4.40 |

| Asia Pacific | 41.9 | % | 7.40 |

| Latin America | 7.3 | % | 1.30 |

| Middle East & Africa | 4.5 | % | 0.80 |

Market Trends China

The main driver of Asia Pacific’s leadership is China because of its overall size and domestic demand. The government focused on promoting bio-based alternatives, using incentives as well as sustainable development goals. Additionally, companies have continued to grow their product portfolios in cosmetics, pharmaceuticals and household cleaning products, where the use oleochemicals has increased significantly.

Why North America showing up as the Fastest Growing Region?

North America expects the fastest growth in the market during the forecast period, due to an increase in sustainability targets and greater demand for bio-based options. Stricter environmental regulations and a growing consumer expectation for natural ingredients are encouraging industries to move in this direction and abandon petroleum-based products. To produce products in the packaging, lubricants, and personal care industry areas, manufacturers have begun incorporating oleochemicals to both comply with regulatory aspects and the natural products’ requirement.

The U.S. is the main contributor to the fast growth in North America. Several key players, such as Emery Oleochemicals, and Univar have expanded their product offerings to supply more than 25 industries. Emerging interest in biodegradable and plant derived inputs that address national initiatives for environmental protection and circular economy practices.

More Insights in Towards Chem and Materials:

Specialty Fertilizers Market : The global specialty fertilizers market volume is calculated at 30.23 million tons in 2024, grew to 31.75 million tons in 2025, and is projected to reach around 49.33 million tons by 2034.The market is expanding at a CAGR of 5.02% between 2025 and 2034.

Fertilizers Market : The global fertilizers market volume reached 193.20 million tons in 2024 and is projected to hit around 262.18 million tons by 2034, expanding at a CAGR of 3.10% during the forecast period from 2025 to 2034.

Polystyrene Market : The global polystyrene market volume was 40.09 million tons in 2024 and is projected to grow from 41.09 million tons in 2025 to 62.33 million tons by 2034, exhibiting a CAGR of 4.51% during the forecast period.

U.S. Specialty Oleochemicals Market : U.S. specialty oleochemicals market size accounted for USD 4.23 billion in 2024 and is predicted to increase from USD 4.57 billion in 2025 to approximately USD 9.23 billion by 2034, expanding at a CAGR of 8.11% from 2025 to 2034.

Polyolefin Market : The global polyolefin market volume was valued at 230.72 million tons in 2024 and is estimated to reach around 371.54 million tons by 2034, exhibiting a compound annual growth rate (CAGR) of 4.88% during the forecast period 2025 to 2034.

Recycled Polyolefin Market ; The global recycled polyolefin market size accounted for USD 61.19 billion in 2024, grew to USD 66.67 billion in 2025, and is expected to be worth around USD 144.2 billion by 2034, poised to grow at a CAGR of 8.95% between 2025 and 2034.

Competitive Landscape in the Oleochemicals Market

- Vantage Specialty Chemicals, Inc.- Major U.S. player providing fatty acids, glycerin and bio-based surfactant chemistries with vertically integrated production in Chicago & Gurnee; supplies personal care, food, industrial markets; > $1 billion sales across 89 countries

- Emery Oleochemicals- One of the U.S.’s largest oleochem producers; six business units covering commodity and specialty chemistries; plants in Cincinnati & Germany; global reach

- Evonik Industries AG- Major global chemical company with strong oleochemical portfolio, especially fatty acid derivatives; ranked among top players

- Wilmar International Ltd.- Leading agribusiness producing palm-based oleochemicals; serves home care, personal care, nutrition, biofuels; Asia-Pacific focus with multibillion USD revenue

- Kao Chemicals Global- Key Asia-based oleochemicals supplier, focusing on cosmetic and personal-care fatty acid derivatives

- Ecogreen Oleochemicals- Indonesia-based oleochem producer listed among the top global firms

- Corbion N.V- European specialist with oleo-ingredient portfolio, recently signed distribution pact in Thailand

- Cargill, Incorporated- One of the leading global players, with significant share in fatty ester and derivative production

- Oleon NV- Belgian oleochem producer recognized as top market competitor

- Godrej Industries- Announced $71.8 m investment in Gujarat to boost oleochemical capacity for personal care, pharma, food

- IOI Corporation Berhad- Malaysian palm-oil major; significant oleochemicals market share

- KLK OLEO- Malaysian leader; together with Cargill holds 15% global share

- Evyap- Turkish-based oleochemicals manufacturer listed among global players

- JNJ Oleochemicals, Incorporated- Filipino oleochemicals firm noted in Philippines industry list

- Sakamoto Yakuhin Kogyo Co., Ltd.- Japanese oleochemicals company among global top players

- Stepan Company- U.S. specialty chemicals firm; key in fatty ester and surfactant production

- Pepmaco Manufacturing Corporation- Philippine manufacturer noted among local oleochem producers

- Philippine International Dev.- Active in oleochem production in the Philippines as part of key players

What is Going Around the Globe?

- In April 2025, Oleon launched Qloe, a line of plant-based immersion cooling fluids (in conjunction with our common sustainable oleochemical product) achieving an oleochemical solution that provides a way to increase energy efficiency and reduce carbon emissions at the level of technical infrastructure in all tech environments and big data centers.

- In March 2024, Arkema’s Oleris® oleochemicals product line received the USDA Certified Biobased Product Label, indicating its content made from 100% renewable carbon, consistent with the sustainable targets it seeks in all its innovation, whether for personal care or industrial use.

- In February 2024, Emery Oleochemicals LLC was recognized with a Silver Medal by EcoVadis for its sustainable operations, further emphasizing its position of leadership in responsible oleochemical manufacturing and corporate environmental responsibility.

Oleochemicals Market Top Key Companies:

Oleochemicals Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chem and Materials has segmented the global Oleochemicals Market

By Product

- Specialty Esters

- Fatty Acid Methyl Ester

- Glycerol Esters

- Alkoxylates

- Fatty Amines

- Other Products

By Application

- Personal Care & Cosmetics

- Consumer Goods

- Food Processing

- Textiles

- Paints & Inks

- Industrial

- Healthcare & Pharmaceuticals

- Polymer & Plastic Additives

- Other Applications

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/price/5537

About Us

Towards Chem and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/