/NOT FOR RELEASE TO US WIRE SERVICES OR DISTRIBUTION IN THE UNITED STATES/

PERTH, Australia, Aug. 5, 2025 /CNW/ – Hot Chili Limited (ASX: HCH) (TSXV: HCH) (OTCQX: HHLKF) (“Hot Chili” or the “Company”) is pleased to announce that the Company will be undertaking a A$14 million funding, exclusively offered to all eligible shareholders.

The A$14 million funding will be via non-renounceable entitlements offer of new shares on a 2 for 13 basis, at an issue price of A$0.60 (60 cents) per share (the “Rights Issue” or “Entitlement Offer”). The Rights Issue provides an opportunity for all eligible shareholders to participate in the funding of the Company at a pivotal time, removing near-term funding uncertainty and providing a pathway to delivering several transformational catalysts over the coming months, including:

- Completion of the Company’s asset-level strategic partnering process

As detailed in the Company’s recent quarterly report for the period ending 30 June 2025 (released 29 July 2025), following completion of the Pre-feasibility Studies (“PFS”) for Costa Fuego and Huasco Water, Hot Chili initiated asset-level strategic partnering processes (“Partnering Process”) to introduce one or more qualified partners with the financial, technical and operational capability to assist in funding and delivering each project. The Partnering Process is ongoing, and the Company confirms it is currently assessing several nonbinding, indicative, incomplete and conditional proposals.

The Partnering Process may result in a range of possible transactions for the projects. Investors are cautioned that there is no certainty the Partnering Process will result in a transaction or binding agreement. The Company will keep the market updated in accordance with its continuous disclosure obligations.

Hot Chili has appointed BMO Capital Markets as its financial adviser in connection with the Partnering Process. - Commencement of phase-two diamond drilling at the La Verde copper-gold discovery

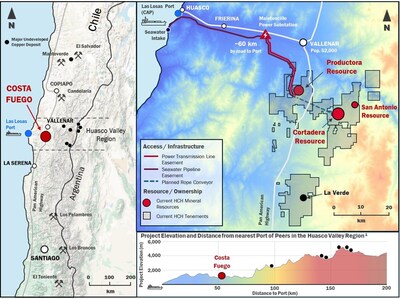

The La Verde copper-gold (Cu-Au) discovery (“La Verde”) is located approximately 30km south of the Company’s Costa Fuego Cu-Au Project (“Costa Fuego” or “the Project”) planned central processing hub, at low elevation, in the coastal range of the Atacama region, Chile.

The Company concluded a phase-one drilling campaign across La Verde on 10 April 2025, with a total of 31 Reverse Circulation (RC) drill holes (9,600 m) completed to date. Drill results have defined an extensive +0.2% Cu mineralisation footprint of 1,000 m by 750 m extending up to 400 m vertical depth and remaining open laterally and at depth.

Importantly, multiple distinct higher-grade centres have been confirmed from near surface, with several stand-out drill results reported including 308m grading 0.5% Cu and 0.3g/t Au from 46m depth to end of hole, which included 100m grading 0.7% Cu, 0.3g/t Au from 118m depth (announced 18 December 2024). Over half of Hot Chili’s drill holes have ended in significant mineralisation (at the depth of RC drill rig capability).

Planned diamond drilling is expected to facilitate a maiden mineral resource estimate for La Verde, providing near-term, material resource growth and potential front-end, open pit, higher grade mine life additions for Costa Fuego.

Hot Chili’ Managing Director Christian Easterday said:

“Funding from the Rights Issue will facilitate another significant upgrade to the Company’s copper and gold resource base at a time of strong market conditions for both commodities.

“A strengthened balance sheet will also provide the Company with the necessary funds to complete its strategic partnering process aimed at potentially unlocking asset-level funding for Costa Fuego and Huasco Water.

“We are very pleased to exclusively offer to all eligible shareholders, full exposure to both near-term, key catalysts which this funding will support.”

Details of the Rights Issue (Entitlement Offer)

The Rights Issue is a non-renounceable pro rata offer of 2 (two) fully paid ordinary shares in the Company (“New Shares”) for every 13 (thirteen) existing shares held by eligible shareholders registered at 5.00pm (AWST) on 8 August 2025 (“Record Date”), at an issue price of A$0.60 (60 cents) per New Share (“Offer Price’), to raise up to approximately $14 million before costs (the “Entitlement Offer”). The Entitlement Offer will be made pursuant to an offer document under section 708AA of the Corporations Act (“Offer Document”).

The Offer Price represents a 3.4% premium to the last closing price of the Company’s shares traded on ASX on 4 August 2025 of A$0.58 and a 4% discount to the 15-day VWAP.

The Entitlement Offer is non-renounceable and is not underwritten.

Eligible shareholders who take up their entitlements in full may also apply for additional New Shares under the shortfall facility to the Entitlement Offer.

In respect to any potential shortfall to the Entitlement Offer, the directors of Hot Chili will reserve the right to allocate any, all, or none of the shortfall to sophisticated and professional investors at their discretion.

The issue of New Shares under the Entitlement Offer and placement of any shortfall to the Entitlement Offer to non-related parties of the Company is not subject to shareholder approval.

The Entitlement Offer and the placement of any shortfall to the Entitlement Offer is exclusively managed by Veritas Securities Limited as lead manager.

Certain insiders of the Company are expected to participate in the Entitlement Offer and as a result, the Entitlement Offer may constitute a “related party transaction” within the meaning of Multilateral Instrument 61-101 – Protection of Minority Shareholders in Special Transactions (“MI 61-101”). The Entitlement Offer is not subject to the formal valuation and minority shareholder approval requirements under MI 61-101 as the Entitlement Offer is a transaction in which the general body of holders of the Company’s ordinary shares in Canada are treated identically on a per share basis and the transaction has no “interested party” within the meaning of MI 61-101. If the Entitlement Offer is subject to the formal valuation and minority shareholder approval requirements under MI 61-101, the Entitlement Offer would in any event be exempt from such requirements in reliance upon the exemptions contained in 5.5(a) and 5.7(1)(a), respectively, of MI 61-101 as the fair market value of the Entitlement Offer, insofar as it involves interested parties, will not be more than 25% of the Company’s market capitalisation.

Full details of the Entitlement Offer are set out in the Offer Document which will be available for review on the Company’s website at www.hotchili.net.au and on SEDAR+ (www.sedarplus.ca) under Hot Chili’s issuer profile.

Timetable

The proposed timetable for the Entitlement Offer is as follows (stated times and dates are times and dates in Perth, Western Australia):

|

Event |

Date |

|

Offer Document, notice under section 708AA(2)(f) of the |

Tuesday, 5 August 2025 |

|

Ex-date (date from which Shares begin trading without the right |

Thursday, 7 August 2025 |

|

Record Date (to identify Shareholders entitled to participate in |

5:00pm (AWST) |

|

Offer Document and Entitlement and Acceptance Forms sent to |

Wednesday, 13 August 2025 |

|

Offer opens (Opening Date) |

Wednesday, 13 August 2025 |

|

Last day to extend the Closing Date |

Before 10:00am (AWST) |

|

Offer closes (Closing Date) |

5:00pm (AWST) |

|

New Shares quoted on ASX on a deferred settlement basis |

Wednesday, 3 September 2025 |

|

Announcement to ASX of Entitlement Offer acceptances and shortfall |

Friday, 5 September 2025 |

|

New Shares issued |

Tuesday, 9 September 2025 |

|

Quotation of New Shares on ASX commences on a normal basis |

Wednesday, 10 September 2025 |

Note: These dates are indicative only and subject to change. Subject to the ASX Listing Rules and the policies of the TSX Venture Exchange (“TSXV”), the Company may vary these dates without notice. In particular, the Company reserves the right to extend the Closing Date and to accept late acceptances either generally or in particular cases. Any extension of the Closing Date will have a consequential effect on the allotment date of New Shares. The commencement of quotation of the New Shares on ASX is subject to confirmation from ASX. The listing of the New Shares on TSXV is subject to the approval of the TSXV.

This announcement is authorised by the Board of Directors for release to ASX and TSXV.

For more information please contact:

|

Christian Easterday

Managing Director – Hot Chili |

Tel: +61 8 9315 9009

Email: admin@hotchili.net.au |

|

Carol Marinkovich

Company Secretary – Hot Chili |

Tel: +61 8 9315 9009

Email: admin@hotchili.net.au |

|

Graham Farrell

|

Email: graham@hotchili.net.au |

|

Investor & Public Relations

or visit Hot Chili’s website at www.hotchili.net.au |

Qualifying Statements

Qualified Person – NI 43-101

The technical information in this announcement has been reviewed and approved by Mr. Christian Easterday, MAIG, Hot Chili’s Managing Director and a qualified person within the meaning of National Instrument 43-101

– Standards of Disclosure for Mineral Projects.

Exploration Results – JORC and ASX

The information in this announcement that relates to exploration results for the La Verde project was previously reported in the Company’s announcements released to ASX on 18 December 2024 ‘Hot Chili Intersects Significant Copper-Gold, Porphyry-style Mineralisation at La Verde’ and 19 May 2025 ‘Hot Chili Announces Latest Drill Results for La Verde, Doubling Porphyry Discovery Footprint’, which are available to view on the Company’s website at www.hotchili.net.au/investors/asx–announcements/. The Company confirms that it is not aware of any new information or data that materially affects the information included in the original market announcements.

Disclaimer

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this announcement.

Forward Looking Statements

This announcement contains certain statements that are “forward-looking information” within the meaning of Canadian securities legislation and Australian securities legislation (each, a “forward-looking statement”). Forward-looking statements reflect the Company’s current expectations, forecasts, and projections with respect to future events, many of which are beyond the Company’s control, and are based on certain assumptions. No assurance can be given that these expectations, forecasts, or projections will prove to be correct, and such forward-looking statements included in this announcement should not be unduly relied upon. Forward-looking information is by its nature prospective and requires the Company to make certain assumptions and is subject to inherent risks and uncertainties. All statements other than statements of historical fact are forward-looking statements. The use of any of the words “estimate”, “expectations”, “may”, “plan”, “potential”, “project”, “reinforce”, “unlock”, “large-scale”, “could”, “should”, “will”, “would”, variants of these words and similar expressions are intended to identify forward-looking statements.

The forward-looking statements within this announcement are based on information currently available and what management believes are reasonable assumptions. Forward-looking statements speak only as of the date of this announcement.

In this announcement, forward-looking statements relate, among other things, to: the Rights Offer, including the timing and results thereof, the receipt of all required regulatory approvals therefor, and the anticipated use of proceeds thereof; the timing and completion, if at all, of the Partnering Process; the potential of the La Verde discovery, including the timing and ability, if at all, to publish a maiden mineral resource estimate; the potential for front-end, open pit, higher grade mine life additions for Costa Fuego; regulatory applications and approvals; the timing and results of future economic studies; and the Company’s future exploration and other business plans.

Forward-looking statements involve known and unknown risks, uncertainties, and other factors, which may cause the actual results, performance, or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. A number of factors could cause actual results to differ materially from a conclusion, forecast or projection contained in the forward-looking statements in this announcement, including, but not limited to, the following material factors: the results of the Rights Offer; the results of the Partnering Process; the ability of drilling and other exploration activities to accurately predict mineralisation; operational risks; risks related to the cost estimates of exploration; sovereign risks associated with the Company’s operations in Chile; changes in estimates of mineral resources or mineral reserves of properties where the Company holds interests; recruiting qualified personnel and retaining key personnel; future financial needs and availability of adequate financing; fluctuations in mineral prices; market volatility; exchange rate fluctuations; ability to exploit successful discoveries; the production at or performance of properties where the Company holds interests; ability to retain title to mining concessions; environmental risks; financial failure or default of joint venture partners, contractors or service providers; competition risks; economic and market conditions; and other risks and uncertainties described elsewhere in this announcement and elsewhere in the Company’s public disclosure record.

Although the forward-looking statements contained in this announcement are based upon assumptions which the Company believes to be reasonable, the Company cannot assure investors that actual results will be consistent with these forward-looking statements. With respect to forward-looking statements contained in this announcement, the Company has made assumptions regarding: future commodity prices and demand; availability of skilled labour; timing and amount of capital expenditures; future currency exchange and interest rates; the impact of increasing competition; general conditions in economic and financial markets; availability of drilling and related equipment; effects of regulation by governmental agencies; future tax rates; future operating costs; availability of future sources of funding; ability to obtain financing; and assumptions underlying estimates related to adjusted funds from operations. The Company has included the above summary of assumptions and risks related to forward-looking information provided in this announcement to provide investors with a more complete perspective on the Company’s future operations, and such information may not be appropriate for other purposes. The Company’s actual results, performance or achievement could differ materially from those expressed in, or implied by, these forward-looking statements and, accordingly, no assurance can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do so, what benefits the Company will derive therefrom.

For additional information with respect to these and other factors and assumptions underlying the forwardlooking statements made herein, please refer to the public disclosure record of the Company, including the Company’s most recent Annual Report, which is available on SEDAR+ (www.sedarplus.ca) under the Company’s issuer profile. New factors emerge from time to time, and it is not possible for management to predict all those factors or to assess in advance the impact of each such factor on the Company’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement.

The forward-looking statements contained in this announcement are expressly qualified by the foregoing cautionary statements and are made as of the date of this announcement. Except as may be required by applicable securities laws, the Company does not undertake any obligation to publicly update or revise any forward-looking statement to reflect events or circumstances after the date of this announcement or to reflect the occurrence of unanticipated events, whether as a result of new information, future events or results, or otherwise. Investors should read this entire announcement and consult their own professional advisors to ascertain and assess the income tax and legal risks and other aspects of an investment in the Company.

Not for release to US wire services or distribution in the United States

This announcement has been prepared for publication in Australia and Canada and may not be released to US news wire services or distributed in the United States. This announcement does not constitute an offer to sell, or a solicitation of an offer to buy, securities in the United States or any other jurisdiction in which such sale, solicitation or offer would be unlawful. Any securities described in this announcement have not been, and will not be, registered under the US Securities Act of 1933 (the “US Securities Act”) and may not be offered or sold in the United States except in transactions exempt from, or not subject to, the registration of the US Securities Act and applicable US state securities laws.

SOURCE Hot Chili Limited