Net Income per Diluted Share of $10.02 for the Quarter, inclusive of Income from Discontinued Operations

Core FFO per Share of $1.76 for the Quarter

North America Same Property NOI for MH and RV Increased by 4.9% for the Quarter on a Year-over-Year Basis

North America Same Property Adjusted Blended Occupancy for MH and RV of 99.0%

Represents a 150 Basis Point Year-over-Year Increase

Over $830 Million of Capital Return to Shareholders,

inclusive of Special Cash Distributions and Share Repurchases

Raising Full-Year 2025 Core FFO per Share Guidance to $6.51 to $6.67

Increasing North American Same Property NOI Growth Guidance to 3.9% – 5.6%

Increasing UK Same Property NOI Growth Guidance to 1.3% – 3.3%

Southfield, MI, July 30, 2025 (GLOBE NEWSWIRE) — Sun Communities, Inc. (NYSE: SUI) (the “Company” or “SUI”), a real estate investment trust (“REIT”) that owns and operates, or has an interest in, manufactured housing (“MH”) and recreational vehicle (“RV”) communities (collectively, the “properties”), today reported its second quarter results for 2025.

Financial Results for the Quarter and Six Months Ended June 30, 2025

- For the quarter ended June 30, 2025, net loss from continuing operations was $92.2 million, or $1.23 per diluted share, compared to net income from continuing operations of $32.7 million, or $0.21 per diluted share for the same period in 2024.

- For the quarter ended June 30, 2025, net income attributable to common shareholders was $1.3 billion, or $10.02 per diluted share, compared to net income attributable to common shareholders of $52.1 million, or $0.42 per diluted share for the same period in 2024.

- For the six months ended June 30, 2025, net loss from continuing operations was $115.3 million, or $1.42 per diluted share, compared to net loss from continuing operations of $4.0 million, or $0.09 per diluted share for the same period in 2024.

- For the six months ended June 30, 2025, net income attributable to common shareholders was $1.2 billion, or $9.68 per diluted share, compared to net income attributable to common shareholders of $24.7 million, or $0.20 per diluted share for the same period in 2024.

Non-GAAP Financial Measures

- Core Funds from Operations (“Core FFO”) for the quarter and six months ended June 30, 2025, was $1.76 per common share and convertible securities (“Share”) and $3.02 per Share, respectively, as compared to $1.86 and $3.05 for the same periods in 2024.

- Same Property Net Operating Income (“NOI”)

- North America Same Property NOI for MH and RV increased by $11.3 million and $20.8 million, or 4.9% and 4.8%, respectively, for the quarter and six months ended June 30, 2025, as compared to the corresponding periods in 2024.

- UK Same Property NOI increased by $2.1 million and $1.6 million, or 10.2% and 5.0%, respectively, for the quarter and six months ended June 30, 2025, as compared to the corresponding periods in 2024.

“We are pleased to report strong second quarter results with earnings ahead of our expectations, as we demonstrated the strength of our platform. It was also one of the most pivotal quarters in our history as we completed the previously announced sale of Safe Harbor Marinas and repositioned Sun as a pure-play owner and operator of manufactured housing and RV communities with a best-in-class balance sheet. This transaction streamlined operations, unlocked meaningful financial flexibility, and enhanced shareholder value,” said Gary A. Shiffman, Chairman and CEO. “We are incredibly excited to welcome Charles Young as Sun’s next CEO in October, as his seasoned leadership and deep real estate expertise will guide the Company through its next phase of growth. After over 40 years as CEO, I am proud to reflect on the Company’s incredible journey knowing our efforts built a strong foundation that uniquely positions Sun for continued growth and long-term value creation.”

OPERATING HIGHLIGHTS

North America Portfolio Occupancy

- MH and annual RV sites were 98.1% occupied at June 30, 2025, as compared to 97.5% at June 30, 2024.

- During the quarter ended June 30, 2025, the number of MH and annual RV revenue producing sites increased by approximately 460 sites.

- During the six months ended June 30, 2025, MH and annual RV revenue producing sites increased by over 470 sites.

Same Property Results

For the properties owned and operated by the Company since at least January 1, 2024, excluding properties classified as discontinued operations, the following table reflects the percentage changes for the quarter ended June 30, 2025, as compared to the same period in 2024:

| Quarter Ended June 30, 2025 | |||||||||||

| North America | |||||||||||

| MH | RV | Total | UK | ||||||||

| Revenue | 6.9 | % | 0.9 | % | 4.6 | % | 9.5 | % | |||

| Expense | 4.7 | % | 3.1 | % | 3.9 | % | 8.8 | % | |||

| NOI | 7.7 | % | (1.1) % | 4.9 | % | 10.2 | % | ||||

| Six Months Ended June 30, 2025 | |||||||||||

| North America | |||||||||||

| MH | RV | Total | UK | ||||||||

| Revenue | 7.1 | % | (0.3) % | 4.5 | % | 5.8 | % | ||||

| Expense | 3.8 | % | 4.1 | % | 3.9 | % | 6.5 | % | |||

| NOI | 8.3 | % | (4.3) % | 4.8 | % | 5.0 | % | ||||

| Number of Properties | 281 | 156 | 437 | 51 | |||||||

North America Same Property adjusted blended occupancy for MH and RV increased by 150 basis points to 99.0% at June 30, 2025, from 97.5% at June 30, 2024.

INVESTMENT ACTIVITY

During the quarter ended June 30, 2025, the Company completed the following dispositions:

- In April 2025, the initial closing of the sale of Safe Harbor Marinas, including a total of 123 marina properties for total cash consideration of $5.25 billion, with a gain on sale of $1.4 billion. See “Balance Sheet, Capital Markets Activity, and Other Items” on page (v) for additional information.

- In May and June 2025, a total of six marina properties for total cash consideration of $136.7 million. See “Balance Sheet, Capital Markets Activity, and Other Items” on page (v) for additional information.

- In June 2025, an MH development property for total cash consideration of $40.0 million, with a gain on sale of $2.6 million. The MH development property was classified as held for sale as of March 31, 2025.

Refer to page 14 for additional details related to the Company’s acquisition and disposition activity.

BALANCE SHEET, CAPITAL MARKETS ACTIVITY, AND OTHER ITEMS

As of June 30, 2025, the Company had $4.3 billion in debt outstanding with a weighted average interest rate of 3.4% and a weighted average maturity of 7.6 years. At June 30, 2025, the Company’s Net Debt to trailing twelve-month Recurring EBITDA ratio was 2.9 times.

Safe Harbor Sale

During the quarter ended June 30, 2025, the Company completed the initial closing (the “Initial Closing”) of its sale of the Safe Harbor Marinas business (the “Safe Harbor Sale”). The Initial Closing of the Safe Harbor Sale generated approximately $5.25 billion of pre-tax cash proceeds, net of transaction costs, with a book gain on sale of $1.4 billion. Pursuant to the terms of the transaction agreement, subsidiaries owning 15 marina properties representing approximately $250.0 million of value (the “Delayed Consent Subsidiaries”) were not part of the Initial Closing. The sales of the Delayed Consent Subsidiaries were subject to the receipt of certain third-party consents at the time of the Initial Closing, which has delayed the timing of any such sale or may prevent any such property from being sold at all. Subsequent to the Initial Closing through June 30, 2025, the Company completed the sale of six Delayed Consent Subsidiaries for $136.7 million. The Company has commenced its plan to deploy the net cash proceeds from the Safe Harbor Sale to support a combination of debt reduction, shareholder distributions, share repurchases, and reinvestment in the Company’s core portfolio.

During the quarter ended June 30, 2025, the Company repaid outstanding debt balances of $1.6 billion under the Company’s senior credit facility and $737.7 million of secured mortgage debt, inclusive of prepayments costs of $45.9 million. The Company also completed the redemption of $956.5 million in outstanding unsecured senior notes, inclusive of prepayment costs of $56.5 million. In conjunction with the debt repayments, the Company terminated three cash flow hedges and realized a gain of $8.7 million from Other Comprehensive Income to earnings due to the discontinuation of cash flow hedge accounting on the extinguished debt instruments. The Company also had $565.3 million in 1031 exchange escrow accounts to fund potential future MH and RV acquisitions, with those funds held as Restricted Cash until and if utilized in connection with potential acquisitions. If some or all of the potential acquisitions are not consummated by October 29, 2025, those funds will be reclassified to unrestricted cash on the Company’s Balance Sheet.

Special Cash Distribution

During the quarter ended June 30, 2025, the Company paid a one-time special cash distribution of $4.00 per common share and common unit, equating to a capital return to shareholders of $521.3 million.

Stock Repurchase Program

During the quarter ended June 30, 2025, the Company repurchased approximately 1.6 million shares of the Company’s common stock at an average cost of $124.03 per share for a total of $202.8 million. Subsequent to the quarter ended June 30, 2025, the Company repurchased approximately 0.8 million shares of the Company’s common stock at an average cost of $126.19 per share for a total of $97.4 million. On a year-to-date basis through July 30, 2025, the Company has repurchased 2.4 million shares of the Company’s common stock at an average cost of $124.73 per share for a total of $300.3 million.

UK Ground Lease Terminations

During the quarter ended June 30, 2025, the Company repurchased the titles to 22 UK properties, previously controlled via ground leases for $199.2 million, inclusive of taxes and fees. In conjunction with the transaction, the Company recorded a lease termination gain of $26.0 million and a Value Added Tax receivable of $31.4 million.

CEO Transition Announcement

In July 2025, the Company announced that its Board of Directors has appointed Charles D. Young as Chief Executive Officer, effective October 1, 2025. Mr. Young, who will also join the Company’s Board of Directors, succeeds Gary Shiffman, who previously announced his planned retirement from the role of CEO after a distinguished 40 years leading Sun. Mr. Young is a seasoned senior real estate and investment executive with over 25 years of leadership experience in real estate operations, development, and investment management. Since March 2023, he has served as President of Invitation Homes, Inc., the nation’s premier single-family home leasing and management company.

2025 GUIDANCE

The Company is updating full-year and establishing third quarter 2025 guidance for diluted EPS and Core FFO per Share as follows:

| Third Quarter Ending September 30, 2025 | Full Year Ending December 31, 2025 | |||||||||||

| Low | High | Low | High | |||||||||

| Diluted EPS attributable to the Consolidated Portfolio(a) | $ | 1.21 | $ | 1.31 | $ | 11.34 | $ | 11.50 | ||||

| Core FFO per Share attributable to the Consolidated Portfolio(a)(b)(c) | $ | 2.13 | $ | 2.23 | $ | 6.51 | $ | 6.67 | ||||

(a) The diluted share counts for the quarter ending September 30, 2025 and the year ending December 31, 2025 are estimated to be 130.1 million and 131.1 million, respectively, which assumes full conversion of all equity participating units, including common and preferred OP units, into the Company’s common stock.

(b) No reconciliation of the forecasted range for Core FFO per share attributable to the Consolidated Portfolio is included in this release because we are unable to quantify certain amounts that would be required to be included in the reconciliation to the comparable GAAP financial measure without unreasonable efforts, particularly with respect to the allocations of itemized adjustments to the Consolidated Portfolio as the initial closing of the Safe Harbor Sale was effective on April 30, 2025, and we believe such reconciliation would imply a degree of precision that could be confusing or misleading to investors.

(c) The Company’s guidance translates forecasted results from operations in the UK using the relevant exchange rate provided in the table presented below. The impact of fluctuations in Canadian and Australian foreign currency rates on guidance are not material.

| Currencies | Exchange Rates | |

| U.S. dollar (“USD”) / pound sterling (“GBP”) | 1.24 | |

| USD / Canadian dollar (“CAD”) | 0.70 | |

| USD / Australian dollar (“AUD”) | 0.62 |

Supplemental Guidance Tables:

| Expected Change in 2025 | |||||||||||||||

| Same Property Portfolio (in millions and %)(a) | FY 2024 Actual Results | Prior FY Range | July 30, 2025 Update | ||||||||||||

| MH NOI (281 properties) | $ | 630.9 | 6.6 | % | – | 7.4 | % | 7.2 | % | – | 7.8 | % | |||

| RV NOI (156 properties) | $ | 280.6 | (3.5 | %) | – | 0.5 | % | (3.5 | %) | – | 0.5 | % | |||

| North America (MH and RV) | |||||||||||||||

| Revenues from real property | $ | 1,385.4 | 3.3 | % | – | 4.1 | % | 3.6 | % | – | 4.4 | % | |||

| Total property operating expenses | 473.9 | 2.0 | % | – | 2.8 | % | 2.2 | % | – | 3.0 | % | ||||

| Total North America Same Property NOI(b) | $ | 911.5 | 3.5 | % | – | 5.2 | % | 3.9 | % | – | 5.6 | % | |||

| UK (51 properties) | |||||||||||||||

| Revenues from real property | $ | 145.8 | 4.6 | % | – | 5.2 | % | 4.3 | % | – | 4.9 | % | |||

| Total property operating expenses | 70.6 | 7.6 | % | – | 8.6 | % | 6.6 | % | – | 7.5 | % | ||||

| Total UK Same Property NOI(b) | $ | 75.2 | 0.9 | % | – | 2.9 | % | 1.3 | % | – | 3.3 | % | |||

For the third quarter ending September 30, 2025, the Company’s guidance range assumes North America Same Property NOI growth of 2.4% – 5.6% and UK Same Property NOI growth of 0.1% – 3.1%.

| Consolidated Portfolio Guidance For 2025 (in millions, excluding marinas) |

Expected Change / Range in FY 2025 | ||||||||||||||

| FY 2024 Actual Results | Prior FY Range | July 30, 2025 Update | |||||||||||||

| Ancillary NOI | $ | 23.6 | $ | 19.0 | – | $ | 21.7 | $ | 19.0 | – | $ | 21.7 | |||

| Interest income | $ | 20.2 | $ | 57.0 | – | $ | 60.0 | $ | 52.9 | – | $ | 55.7 | |||

| Brokerage commissions and other, net(c) | $ | 44.5 | $ | 32.8 | – | $ | 39.3 | $ | 32.8 | – | $ | 39.3 | |||

| FFO contribution from North American home sales | $ | 9.9 | $ | 3.5 | – | $ | 5.1 | $ | 3.5 | – | $ | 5.1 | |||

| FFO contribution from UK home sales | $ | 59.9 | $ | 56.4 | – | $ | 63.0 | $ | 56.4 | – | $ | 63.0 | |||

| General and administrative expenses excluding non-recurring expenses | $ | 196.3 | $ | 194.6 | – | $ | 198.1 | $ | 194.6 | – | $ | 198.1 | |||

| Interest expense | $ | 350.3 | $ | 225.8 | – | $ | 228.0 | $ | 221.0 | – | $ | 224.0 | |||

| Current tax expense | $ | 3.6 | $ | 13.0 | – | $ | 15.1 | $ | 13.0 | – | $ | 15.1 | |||

| Seasonality (excluding marinas) | 1Q25 | 2Q25 | 3Q25 | 4Q25 | ||||||||

| North America Same Property NOI: | ||||||||||||

| MH | 25 | % | 25 | % | 25 | % | 25 | % | ||||

| RV | 16 | % | 26 | % | 39 | % | 19 | % | ||||

| Total | 23 | % | 25 | % | 29 | % | 23 | % | ||||

| UK Same Property NOI | 13 | % | 30 | % | 37 | % | 20 | % | ||||

| Home Sales FFO | ||||||||||||

| North America | 11 | % | 55 | % | 27 | % | 7 | % | ||||

| UK | 17 | % | 29 | % | 34 | % | 20 | % | ||||

| Consolidated Ancillary NOI | (11 | )% | 34 | % | 79 | % | (2 | )% | ||||

| Consolidated EBITDA(d) | 22 | % | 26 | % | 31 | % | 21 | % | ||||

| Core FFO per Share(d)(e) | 19 | % | 27 | % | 33 | % | 21 | % | ||||

| Footnotes to Supplemental Guidance Tables: | |||||

| (a) | The amounts in the Same Property Portfolio table reflect constant currency, as Canadian dollar and pound sterling figures included within the 2024 amounts have been translated at the assumed exchange rates used for 2025 guidance. | ||||

| (b) | Total North America Same Property results net $90.5 million and $95.1 million of utility revenue against the related utility expense in property operating expenses for 2024 results and 2025 guidance, respectively. Total UK Same Property results net $17.8 million and $20.2 million of utility revenue against the related utility expense in property operating expenses for 2024 results and 2025 guidance, respectively. | ||||

| (c) | Brokerage commissions and other, net includes approximately $18.0 million and $13.9 million of business interruption income and $9.5 million and $13.5 million of income from nonconsolidated affiliates for full year 2024 results and 2025 guidance, respectively. | ||||

| (d) | Includes realized contribution from marinas through the date of the initial closing of the Safe Harbor Sale and the expected contribution from the Delayed Consent Subsidiaries subsequent to the initial closing of the Safe Harbor Sale. | ||||

| (e) | Assumes full conversion of all equity participating units, including common and preferred OP units, into the Company’s common stock. | ||||

The estimates and assumptions presented above represent a range of possible outcomes and may differ materially from actual results. These estimates include contributions from all acquisitions, dispositions and capital markets activity completed through July 30, 2025, and the effect of the completion of the sale of the remaining Delayed Consent Subsidiaries from the Safe Harbor Sale. These estimates exclude all other prospective acquisitions, dispositions and capital markets activity. The estimates and assumptions are forward-looking based on the Company’s current assessment of economic and market conditions and are subject to the other risks outlined below under the caption Cautionary Statement Regarding Forward-Looking Statements.

EARNINGS CONFERENCE CALL

A conference call to discuss second quarter results will be held on Thursday, July 31, 2025 at 2:00 P.M. (ET). To participate, call toll-free at (877) 407-9039. Callers outside the U.S. or Canada can access the call at (201) 689-8470. A replay will be available following the call through August 14, 2025 and can be accessed toll-free by calling (844) 512-2921 or (412) 317-6671. The Conference ID number for the call and the replay is 13754394. The conference call will be available live on the Company’s website located at www.suninc.com. The replay will also be available on the website.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This press release contains various “forward-looking statements” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”), and the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Company intends that such forward-looking statements will be subject to the safe harbors created thereby. For this purpose, any statements contained in this document that relate to expectations, beliefs, projections, future plans and strategies, trends or prospective events or developments, and similar expressions concerning matters that are not historical facts are deemed to be forward-looking statements. Words such as “forecasts,” “intend,” “goal,” “estimate,” “expect,” “project,” “projections,” “plans,” “predicts,” “potential,” “seeks,” “anticipates,” “should,” “could,” “may,” “will,” “designed to,” “foreseeable future,” “believe,” “scheduled,” “guidance,” “target,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these words. These forward-looking statements reflect the Company’s current views with respect to future events and financial performance, but involve known and unknown risks, uncertainties, and other factors, both general and specific to the matters discussed in this document, some of which are beyond the Company’s control. These risks, uncertainties, and other factors may cause the Company’s actual results to be materially different from any future results expressed or implied by such forward-looking statements. In addition to the risks described under “Risk Factors” contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024, in Part II, Item 1A of the Company’s Quarterly Report on Form 10-Q for the three months ended March 31, 2025, and in the Company’s other filings with the Securities and Exchange Commission, from time to time, such risks, uncertainties and other factors include, but are not limited to:

| ∙ | The Company’s liquidity and refinancing demands; |

| ∙ | The Company’s ability to obtain or refinance maturing debt; |

| ∙ | The Company’s ability to maintain compliance with covenants contained in its debt facilities and its unsecured notes; |

| ∙ | Availability of capital; |

| ∙ | General volatility of the capital markets and the market price of shares of the Company’s capital stock; |

| ∙ | Increases in interest rates and operating costs, including insurance premiums and real estate taxes; |

| ∙ | Difficulties in the Company’s ability to evaluate, finance, complete and integrate acquisitions, developments and expansions successfully; |

| ∙ | The ability of the Company to complete the sale of the remaining Safe Harbor properties that are subject to receipt of third-party consents on a timely basis or at all; |

| ∙ | The ability of the Company to realize the anticipated benefits of the Safe Harbor Sale, including with respect to tax strategies, or at all; |

| ∙ | The Company’s succession plan for its CEO, which could impact the execution of the Company’s strategic plan; |

| ∙ | Competitive market forces; |

| ∙ | The ability of purchasers of manufactured homes to obtain financing; |

| ∙ | The level of repossessions of manufactured homes; |

| ∙ | The Company’s ability to maintain effective internal control over financial reporting and disclosure controls and procedures; |

| ∙ | The Company’s remediation plan and its ability to remediate the material weakness in its internal control over financial reporting; |

| ∙ | Expectations regarding the amount or frequency of impairment losses; |

| ∙ | Changes in general economic conditions, including inflation, deflation, energy costs, the real estate industry, the effects of tariffs or threats of tariffs, trade wars, immigration issues, supply chain disruptions, and the markets within which the Company operates; |

| ∙ | Changes in foreign currency exchange rates, including between the U.S. dollar and each of the Canadian dollar, Australian dollar, and pound sterling; |

| ∙ | The Company’s ability to maintain its status as a REIT; |

| ∙ | Changes in real estate and zoning laws and regulations; |

| ∙ | The Company’s ability to maintain rental rates and occupancy levels; |

| ∙ | Legislative or regulatory changes, including changes to laws governing the taxation of REITs; |

| ∙ | Outbreaks of disease and related restrictions on business operations; |

| ∙ | Risks related to natural disasters such as hurricanes, earthquakes, floods, droughts, and wildfires; and |

| ∙ | Litigation, judgments or settlements, including costs associated with prosecuting or defending claims and any adverse outcomes; |

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made. The Company undertakes no obligation to publicly update or revise any forward-looking statements included or incorporated by reference into this document, whether as a result of new information, future events, changes in the Company’s expectations or otherwise, except as required by law.

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, the Company cannot guarantee future results, levels of activity, performance or achievements. All written and oral forward-looking statements attributable to the Company or persons acting on the Company’s behalf are qualified in their entirety by these cautionary statements.

Company Overview and Investor Information

The Company

Established in 1975, Sun Communities, Inc. became a publicly owned corporation in December 1993. The Company is a fully integrated REIT listed on the New York Stock Exchange under the symbol: SUI. As of June 30, 2025, the Company owned, operated, or had an interest in a portfolio of 501 developed MH, RV, and UK properties comprising approximately 174,450 developed sites in the U.S., Canada, and the U.K. The Company also owned, operated, or held an interest in a portfolio of nine marina properties comprising approximately 3,880 wet slips and dry storage spaces in the U.S., which were classified within discontinued operations as of June 30, 2025.

For more information about the Company, please visit www.suninc.com.

| Company Contacts | |

| Investor Relations | |

| Sara Ismail, Senior Vice President | |

| (248) 208-2500 | |

| investorrelations@suncommunities.com |

| Corporate Debt Ratings | |

| Moody’s | S&P |

| Baa2 | Stable | BBB+ | Stable |

| Equity Research Coverage | ||||

| Bank of America Merrill Lynch | Jana Galan | jana.galan@bofa.com | ||

| Barclays | Richard Hightower | richard.hightower@barclays.com | ||

| Jason Wayne | jason.wayne@barclays.com | |||

| BMO Capital Markets | John Kim | jp.kim@bmo.com | ||

| Citi Research | Nicholas Joseph | nicholas.joseph@citi.com | ||

| Eric Wolfe | eric.wolfe@citi.com | |||

| Colliers | Barry Oxford | barry.oxford@colliers.com | ||

| Deutsche Bank | Omotayo Okusanya | omotayo.okusanya@db.com | ||

| Conor Peaks | conor.peaks@db.com | |||

| Evercore ISI | Steve Sakwa | steve.sakwa@evercoreisi.com | ||

| Green Street Advisors | John Pawlowski | jpawlowski@greenstreet.com | ||

| Jefferies LLC | Peter Abramowitz | pabramowitz@jefferies.com | ||

| JMP Securities | Aaron Hecht | ahecht@jmpsecurities.com | ||

| Morgan Stanley | Adam Kramer | adam.kramer@morganstanley.com | ||

| Derrick Metzler | derrick.metzler@morganstanley.com | |||

| RBC Capital Markets | Brad Heffern | brad.heffern@rbccm.com | ||

| Robert W. Baird & Co. | Wesley Golladay | wgolladay@rwbaird.com | ||

| Truist Securities | Anthony Hau | anthony.hau@truist.com | ||

| UBS | Michael Goldsmith | michael.goldsmith@ubs.com | ||

| Wells Fargo | James Feldman | james.feldman@wellsfargo.com | ||

| Wolfe Research | Andrew Rosivach | arosivach@wolferesearch.com |

Financial and Operating Highlights

($ in millions, except Per Share amounts, Unaudited)

| Quarters Ended | |||||||||||||||||||

| 6/30/2025 | 3/31/2025 | 12/31/2024 | 9/30/2024 | 6/30/2024 | |||||||||||||||

| Financial Information | |||||||||||||||||||

| Basic earnings / (loss) per share from continuing operations | $ | (1.23 | ) | $ | (0.19 | ) | $ | (1.84 | ) | $ | 2.09 | $ | 0.21 | ||||||

| Basic earnings / (loss) per share from discontinued operations | 11.25 | (0.15 | ) | 0.08 | 0.22 | 0.21 | |||||||||||||

| Basic earnings / (loss) per share | $ | 10.02 | $ | (0.34 | ) | $ | (1.76 | ) | $ | 2.31 | $ | 0.42 | |||||||

| Diluted earnings / (loss) per share from continuing operations | $ | (1.23 | ) | $ | (0.19 | ) | $ | (1.85 | ) | $ | 2.09 | $ | 0.21 | ||||||

| Diluted earnings / (loss) per share from discontinued operations | 11.25 | (0.15 | ) | 0.08 | 0.22 | 0.21 | |||||||||||||

| Diluted earnings / (loss) per share | $ | 10.02 | $ | (0.34 | ) | $ | (1.77 | ) | $ | 2.31 | $ | 0.42 | |||||||

| Cash distributions declared per common share(a) | $ | 1.04 | $ | 0.94 | $ | 0.94 | $ | 0.94 | $ | 0.94 | |||||||||

| FFO per Share(b) | $ | 1.36 | $ | 1.06 | $ | 1.30 | $ | 2.19 | $ | 1.79 | |||||||||

| Core FFO per Share(b) | $ | 1.76 | $ | 1.26 | $ | 1.41 | $ | 2.34 | $ | 1.86 | |||||||||

| Real Property NOI(b) | |||||||||||||||||||

| MH | $ | 168.6 | $ | 172.5 | $ | 161.9 | $ | 158.3 | $ | 160.7 | |||||||||

| RV | 72.9 | 44.7 | 50.4 | 117.0 | 74.2 | ||||||||||||||

| UK | 22.1 | 9.2 | 16.3 | 28.8 | 18.7 | ||||||||||||||

| Total | $ | 263.6 | $ | 226.4 | $ | 228.6 | $ | 304.1 | $ | 253.6 | |||||||||

| Recurring EBITDA(b) | $ | 291.3 | $ | 236.7 | $ | 271.5 | $ | 382.6 | $ | 335.9 | |||||||||

| TTM Recurring EBITDA / Interest(b) | 3.8 x | 3.6 x | 3.5 x | 3.4 x | 3.6 x | ||||||||||||||

| Net Debt / TTM Recurring EBITDA(b) | 2.9 x | 5.9 x | 6.0 x | 6.0 x | 6.2 x | ||||||||||||||

| Balance Sheet | |||||||||||||||||||

| Total assets | $ | 13,362.1 | $ | 16,505.6 | $ | 16,549.4 | $ | 17,085.1 | $ | 17,011.1 | |||||||||

| Total debt | $ | 4,283.5 | $ | 7,348.1 | $ | 7,352.8 | $ | 7,324.8 | $ | 7,852.8 | |||||||||

| Total liabilities | $ | 5,570.0 | $ | 9,235.4 | $ | 9,096.8 | $ | 9,245.7 | $ | 9,781.6 | |||||||||

| Operating Information | |||||||||||||||||||

| Properties | |||||||||||||||||||

| MH | 284 | 284 | 287 | 287 | 295 | ||||||||||||||

| RV | 164 | 165 | 167 | 180 | 180 | ||||||||||||||

| UK | 53 | 53 | 53 | 54 | 54 | ||||||||||||||

| Total | 501 | 502 | 507 | 521 | 529 | ||||||||||||||

| Sites | |||||||||||||||||||

| MH | 97,380 | 97,320 | 97,430 | 97,300 | 100,160 | ||||||||||||||

| Annual RV | 32,100 | 31,960 | 32,100 | 34,480 | 33,590 | ||||||||||||||

| Transient | 23,440 | 23,810 | 24,830 | 25,060 | 25,720 | ||||||||||||||

| UK annual | 17,510 | 17,510 | 17,690 | 17,790 | 17,710 | ||||||||||||||

| UK transient | 4,020 | 4,250 | 4,340 | 4,500 | 4,580 | ||||||||||||||

| Total sites | 174,450 | 174,850 | 176,390 | 179,130 | 181,760 | ||||||||||||||

| Occupancy | |||||||||||||||||||

| MH | 97.4 | % | 97.3 | % | 97.3 | % | 96.9 | % | 96.7 | % | |||||||||

| Annual RV | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | |||||||||

| Blended MH and annual RV | 98.1 | % | 98.0 | % | 98.0 | % | 97.7 | % | 97.5 | % | |||||||||

| UK annual | 90.3 | % | 89.8 | % | 89.7 | % | 91.5 | % | 89.9 | % | |||||||||

| MH and RV Revenue Producing Site Net Gains(c) | |||||||||||||||||||

| MH leased sites, net | 170 | 47 | 406 | 159 | 315 | ||||||||||||||

| RV leased sites, net | 288 | (31 | ) | 304 | 893 | 918 | |||||||||||||

| Total leased sites, net | 458 | 16 | 710 | 1,052 | 1,233 | ||||||||||||||

(a) During the quarter ended June 30, 2025, the Company also paid a one-time special cash distribution of $4.00 per common share and unit.

(b) Refer to Definition and Notes for additional information.

(c) Revenue producing site net gains do not include occupied sites acquired during the year.

Portfolio Overview as of June 30, 2025(a)

| MH & RV Properties | |||||||||||||

| Properties | MH & Annual RV | Transient RV Sites |

Total Sites | Sites for Development | |||||||||

| Location | Sites | Occupancy % | |||||||||||

| North America | |||||||||||||

| Florida | 124 | 41,230 | 98.0 | % | 4,020 | 45,250 | 1,720 | ||||||

| Michigan | 85 | 33,030 | 97.9 | % | 510 | 33,540 | 1,290 | ||||||

| California | 37 | 7,010 | 99.3 | % | 1,810 | 8,820 | 570 | ||||||

| Texas | 29 | 9,300 | 98.0 | % | 1,620 | 10,920 | 3,850 | ||||||

| Connecticut | 16 | 1,900 | 96.6 | % | 100 | 2,000 | — | ||||||

| Maine | 15 | 2,560 | 97.6 | % | 990 | 3,550 | 200 | ||||||

| Arizona | 11 | 4,170 | 97.7 | % | 840 | 5,010 | 1,120 | ||||||

| Indiana | 11 | 2,950 | 98.8 | % | 990 | 3,940 | 180 | ||||||

| New Jersey | 11 | 3,090 | 100.0 | % | 920 | 4,010 | 260 | ||||||

| Colorado | 11 | 3,000 | 89.4 | % | 870 | 3,870 | 1,390 | ||||||

| New York | 10 | 1,560 | 98.8 | % | 1,620 | 3,180 | 780 | ||||||

| Other | 88 | 19,680 | 99.2 | % | 9,150 | 28,830 | 1,530 | ||||||

| Total | 448 | 129,480 | 98.1 | % | 23,440 | 152,920 | 12,890 | ||||||

| Properties | UK Properties | Transient Sites | Total Sites | Sites for Development | |||||||||

| Location | Sites | Occupancy % | |||||||||||

| United Kingdom | 53 | 17,510 | 90.3 | % | 4,020 | 21,530 | 3,130 | ||||||

| Properties | Total Sites | |||||||

| Total Portfolio(a) | 501 | 174,450 |

(a) The Company also owned nine marina properties with 3,880 total wet slips and dry storage spaces, which were classified within held for sale and discontinued operations as of June 30, 2025.

Consolidated Balance Sheets

(amounts in millions)

| (Unaudited) | |||||||

| June 30, 2025 | December 31, 2024 | ||||||

| Assets | |||||||

| Land | $ | 3,443.9 | $ | 3,461.5 | |||

| Land improvements and buildings | 9,076.8 | 9,058.7 | |||||

| Rental homes and improvements | 864.9 | 834.1 | |||||

| Furniture, fixtures and equipment | 779.4 | 739.2 | |||||

| Investment property | 14,165.0 | 14,093.5 | |||||

| Accumulated depreciation | (3,431.9 | ) | (3,228.4 | ) | |||

| Investment property, net | 10,733.1 | 10,865.1 | |||||

| Cash, cash equivalents and restricted cash(a) | 1,463.1 | 57.1 | |||||

| Inventory of manufactured homes | 172.0 | 129.8 | |||||

| Notes and other receivables, net | 345.7 | 430.1 | |||||

| Collateralized receivables, net(b) | 46.6 | 51.2 | |||||

| Goodwill | 9.5 | 9.5 | |||||

| Other intangible assets, net | 101.7 | 102.5 | |||||

| Other assets, net | 369.3 | 442.4 | |||||

| Assets held for sale and discontinued operations, net(c) | 121.1 | 4,461.7 | |||||

| Total Assets | $ | 13,362.1 | $ | 16,549.4 | |||

| Liabilities | |||||||

| Mortgage loans payable | $ | 2,451.6 | $ | 3,212.2 | |||

| Secured borrowings on collateralized receivables(b) | 46.6 | 51.2 | |||||

| Unsecured debt | 1,785.3 | 4,089.4 | |||||

| Distributions payable | 133.8 | 122.6 | |||||

| Advanced reservation deposits and rent | 308.2 | 249.4 | |||||

| Accrued expenses and accounts payable | 262.1 | 265.8 | |||||

| Other liabilities | 545.8 | 819.3 | |||||

| Liabilities held for sale and discontinued operations, net(c) | 36.6 | 286.9 | |||||

| Total Liabilities | 5,570.0 | 9,096.8 | |||||

| Commitments and contingencies | |||||||

| Temporary equity | 257.9 | 259.8 | |||||

| Shareholders’ Equity | |||||||

| Common stock | 1.3 | 1.3 | |||||

| Additional paid-in capital | 9,744.7 | 9,864.2 | |||||

| Accumulated other comprehensive income / (loss) | 44.2 | (7.9 | ) | ||||

| Distributions in excess of accumulated earnings | (2,380.3 | ) | (2,775.9 | ) | |||

| Total SUI Shareholders’ Equity | 7,409.9 | 7,081.7 | |||||

| Noncontrolling interests | |||||||

| Common and preferred OP units | 123.9 | 110.4 | |||||

| Consolidated entities | 0.4 | 0.7 | |||||

| Total noncontrolling interests | 124.3 | 111.1 | |||||

| Total Shareholders’ Equity | 7,534.2 | 7,192.8 | |||||

| Total Liabilities, Temporary Equity and Shareholders’ Equity | $ | 13,362.1 | $ | 16,549.4 | |||

(a) Refer to “Cash, Cash Equivalents and Restricted Cash” within Definitions and Notes for additional information.

(b) Refer to “Secured borrowings on collateralized receivables” within Definitions and Notes for additional information.

(c) Refer to “Discontinued Operations” within Definitions and Notes for additional information.

Consolidated Statements of Operations

(amounts in millions, except for per share amounts)

| Quarter Ended | Six Months Ended | ||||||||||||||||||||

| June 30, 2025 | June 30, 2024 | % Change | June 30, 2025 | June 30, 2024 | % Change | ||||||||||||||||

| Revenues | |||||||||||||||||||||

| Real property (excluding transient)(a) | $ | 368.8 | $ | 351.0 | 5.1 | % | $ | 722.7 | $ | 694.0 | 4.1 | % | |||||||||

| Real property – transient | 81.4 | 81.6 | (0.2) % | 111.9 | 119.1 | (6.0) % | |||||||||||||||

| Home sales | 100.1 | 107.5 | (6.9) % | 167.3 | 176.4 | (5.2) % | |||||||||||||||

| Ancillary | 42.1 | 40.6 | 3.7 | % | 54.6 | 53.9 | 1.3 | % | |||||||||||||

| Interest | 16.5 | 5.2 | 217.3 | % | 20.9 | 9.7 | 115.5 | % | |||||||||||||

| Brokerage commissions and other, net | 14.6 | 10.4 | 40.4 | % | 16.3 | 12.4 | 31.5 | % | |||||||||||||

| Total Revenues | 623.5 | 596.3 | 4.6 | % | 1,093.7 | 1,065.5 | 2.6 | % | |||||||||||||

| Expenses | |||||||||||||||||||||

| Property operating and maintenance(a) | 157.9 | 152.8 | 3.3 | % | 289.2 | 278.8 | 3.7 | % | |||||||||||||

| Real estate tax | 28.7 | 26.2 | 9.5 | % | 55.4 | 51.7 | 7.2 | % | |||||||||||||

| Home costs and selling | 76.8 | 76.8 | — | % | 129.4 | 128.7 | 0.5 | % | |||||||||||||

| Ancillary | 33.5 | 32.2 | 4.0 | % | 48.9 | 48.4 | 1.0 | % | |||||||||||||

| General and administrative | 61.2 | 49.8 | 22.9 | % | 118.2 | 111.6 | 5.9 | % | |||||||||||||

| Catastrophic event-related charges, net | 0.4 | 2.3 | (82.6) % | 0.3 | 9.5 | (96.8) % | |||||||||||||||

| Depreciation and amortization | 127.4 | 123.0 | 3.6 | % | 251.1 | 244.0 | 2.9 | % | |||||||||||||

| Asset impairments(a) | 166.1 | 10.6 | N/M | 190.1 | 30.4 | N/M | |||||||||||||||

| Loss on extinguishment of debt | 102.4 | — | N/A | 102.4 | 0.6 | N/M | |||||||||||||||

| Interest | 58.2 | 89.8 | (35.2) % | 140.3 | 179.5 | (21.8) % | |||||||||||||||

| Total Expenses | 812.6 | 563.5 | 44.2 | % | 1,325.3 | 1,083.2 | 22.4 | % | |||||||||||||

| Income / (Loss) Before Other Items | (189.1 | ) | 32.8 | N/M | (231.6 | ) | (17.7 | ) | N/M | ||||||||||||

| Gain / (loss) on foreign currency exchanges | 39.4 | (2.8 | ) | N/M | 48.1 | (1.7 | ) | N/M | |||||||||||||

| Gain / (loss) on dispositions of properties | (1.3 | ) | 2.5 | N/M | (2.4 | ) | 7.9 | N/M | |||||||||||||

| Other income / (expense), net(a) | 31.9 | (1.1 | ) | N/M | 37.6 | (3.5 | ) | N/M | |||||||||||||

| Loss on remeasurement of notes receivable | (1.4 | ) | (0.4 | ) | 250.0 | % | (1.6 | ) | (1.1 | ) | 45.5 | % | |||||||||

| Income from nonconsolidated affiliates | 3.8 | 3.0 | 26.7 | % | 6.8 | 4.4 | 54.5 | % | |||||||||||||

| Gain / (loss) on remeasurement of investment in nonconsolidated affiliates | (1.5 | ) | 0.1 | N/M | (1.5 | ) | 5.3 | N/M | |||||||||||||

| Current tax expense | (6.1 | ) | (5.1 | ) | 19.6 | % | (8.0 | ) | (7.0 | ) | 14.3 | % | |||||||||

| Deferred tax benefit | 32.1 | 3.7 | N/M | 37.3 | 9.4 | 296.8 | % | ||||||||||||||

| Net Income / (Loss) from Continuing Operations | (92.2 | ) | 32.7 | N/M | (115.3 | ) | (4.0 | ) | N/M | ||||||||||||

| Income from discontinued operations, net(a) | 1,422.5 | 25.7 | N/M | 1,404.0 | 36.9 | N/M | |||||||||||||||

| Net Income | 1,330.3 | 58.4 | N/M | 1,288.7 | 32.9 | N/M | |||||||||||||||

| Less: Preferred return to preferred OP units / equity interests | 3.2 | 3.2 | — | % | 6.3 | 6.4 | (1.6) % | ||||||||||||||

| Less: Income attributable to noncontrolling interests | 53.5 | 3.1 | N/M | 51.6 | 1.8 | N/M | |||||||||||||||

| Net Income Attributable to SUI Common Shareholders | $ | 1,273.6 | $ | 52.1 | N/M | $ | 1,230.8 | $ | 24.7 | N/M | |||||||||||

| Weighted average common shares outstanding – basic(a) | 126.4 | 123.7 | 2.2 | % | 126.5 | 123.7 | 2.3 | % | |||||||||||||

| Weighted average common shares outstanding – diluted(a) | 126.4 | 123.7 | 2.2 | % | 126.5 | 126.4 | 0.1 | % | |||||||||||||

| Basic earnings / (loss) per share from continuing operations | $ | (1.23 | ) | $ | 0.21 | N/M | $ | (1.42 | ) | $ | (0.10 | ) | N/M | ||||||||

| Basic earnings per share from discontinued operations | 11.25 | 0.21 | N/M | 11.10 | 0.30 | N/M | |||||||||||||||

| Basic earnings per share | $ | 10.02 | $ | 0.42 | N/M | $ | 9.68 | $ | 0.20 | N/M | |||||||||||

| Diluted earnings / (loss) per share from continuing operations(b) | $ | (1.23 | ) | $ | 0.21 | N/M | $ | (1.42 | ) | $ | (0.09 | ) | N/M | ||||||||

| Diluted earnings per share from discontinued operations(b) | 11.25 | 0.21 | N/M | 11.10 | 0.29 | N/M | |||||||||||||||

| Diluted earnings per share(b) | $ | 10.02 | $ | 0.42 | N/M | $ | 9.68 | $ | 0.20 | N/M | |||||||||||

(a) Refer to Definitions and Notes for additional information.

(b) Excludes the effect of certain anti-dilutive convertible securities.

N/M = Not meaningful. N/A = Not applicable.

Reconciliation of Net Income Attributable to SUI Common Shareholders to Core FFO

(amounts in millions, except for per share data)

| Quarter Ended | Six Months Ended | ||||||||||||||

| June 30, 2025 | June 30, 2024 | June 30, 2025 | June 30, 2024 | ||||||||||||

| Net Income Attributable to SUI Common Shareholders | $ | 1,273.6 | $ | 52.1 | $ | 1,230.8 | $ | 24.7 | |||||||

| Adjustments | |||||||||||||||

| Depreciation and amortization – continuing operations(a) | 126.3 | 122.4 | 248.9 | 242.6 | |||||||||||

| Depreciation and amortization – discontinued operations(a) | (0.3 | ) | 49.6 | 36.1 | 93.9 | ||||||||||

| Depreciation on nonconsolidated affiliates | 0.2 | 0.1 | 0.4 | 0.2 | |||||||||||

| Asset impairments – continuing operations(a) | 166.1 | 10.6 | 190.1 | 30.4 | |||||||||||

| Asset impairments – discontinued operations(a) | 0.2 | 1.0 | 2.3 | 1.9 | |||||||||||

| (Gain) / loss on remeasurement of investment in nonconsolidated affiliates | 1.5 | (0.1 | ) | 1.5 | (5.3 | ) | |||||||||

| Loss on remeasurement of notes receivable | 1.4 | 0.4 | 1.6 | 1.1 | |||||||||||

| (Gain) / loss on dispositions of properties, including tax effect – continuing operations | 2.9 | (1.8 | ) | 4.0 | (7.1 | ) | |||||||||

| Gain on dispositions of properties, including tax effect – discontinued operations | (1,445.0 | ) | — | (1,445.0 | ) | — | |||||||||

| Add: Returns on preferred OP units | 3.1 | 3.2 | 6.2 | 6.3 | |||||||||||

| Add: Income attributable to noncontrolling interests | 53.5 | 2.9 | 51.7 | 1.8 | |||||||||||

| Gain on disposition of assets, net | (4.0 | ) | (8.6 | ) | (7.9 | ) | (14.0 | ) | |||||||

| FFO(a)(c)(d) | $ | 179.5 | $ | 231.8 | $ | 320.7 | $ | 376.5 | |||||||

| Adjustments | |||||||||||||||

| Business combination expense – discontinued operations | — | 0.2 | — | 0.2 | |||||||||||

| Acquisition and other transaction costs – continuing operations(a) | 6.7 | 1.5 | 16.3 | 10.5 | |||||||||||

| Acquisition and other transaction costs – discontinued operations(a) | 48.4 | 1.6 | 62.9 | 2.5 | |||||||||||

| Loss on extinguishment of debt | 102.4 | — | 102.4 | 0.6 | |||||||||||

| Catastrophic event-related charges, net | 0.4 | 2.3 | 0.3 | 9.5 | |||||||||||

| Loss of earnings – catastrophic event-related charges, net(b) | (5.7 | ) | 0.3 | (1.7 | ) | 5.6 | |||||||||

| (Gain) / loss on foreign currency exchanges | (39.4 | ) | 2.8 | (48.1 | ) | 1.7 | |||||||||

| Other adjustments, net – continuing operations(a) | (60.8 | ) | (1.0 | ) | (68.7 | ) | (3.0 | ) | |||||||

| Other adjustments, net – discontinued operations(a) | 0.3 | 0.5 | 14.8 | (9.9 | ) | ||||||||||

| Core FFO(a)(c)(d) | $ | 231.8 | $ | 240.0 | $ | 398.9 | $ | 394.2 | |||||||

| Weighted Average Common Shares and OP Units Outstanding(a)(c) | 131.8 | 129.3 | 132.1 | 129.3 | |||||||||||

| FFO per Share(a)(c)(d)(e) | $ | 1.36 | $ | 1.79 | $ | 2.43 | $ | 2.91 | |||||||

| Core FFO per Share(a)(c)(d)(e) | $ | 1.76 | $ | 1.86 | $ | 3.02 | $ | 3.05 | |||||||

(a) Refer to Definitions and Notes for additional information.

(b) Loss of earnings – catastrophic event-related charges, net include the following:

| Quarter Ended | Six Months Ended | ||||||||||||||

| June 30, 2025 | June 30, 2024 | June 30, 2025 | June 30, 2024 | ||||||||||||

| Hurricane Ian – Estimated loss of earnings in excess of the applicable business interruption deductible | $ | 4.1 | $ | 5.3 | $ | 7.9 | $ | 10.6 | |||||||

| Hurricane Ian – Insurance recoveries realized for previously estimated loss of earnings | (9.9 | ) | (5.0 | ) | (9.9 | ) | (5.0 | ) | |||||||

| Hurricane Helene – Estimated loss of earnings in excess of the applicable business interruption deductible, net | 0.1 | — | 0.3 | — | |||||||||||

| Loss of earnings – catastrophic event-related charges, net | $ | (5.7 | ) | $ | 0.3 | $ | (1.7 | ) | $ | 5.6 | |||||

(c) Assumes full conversion of all equity participating units, including common and preferred OP units, into the Company’s common stock, and has no material impact on previously reported results.

(d) FFO and Core FFO include discontinued operations activity of $(22.6) million or $(0.17) per Share, and $26.2 million or $0.20 per Share, respectively, during the quarter ended June 30, 2025, and $76.3 million or $0.59 per Share, and $78.6 million or $0.61 per Share, respectively, during the quarter ended June 30, 2024.

(e) FFO and Core FFO include discontinued operations activity of $(2.6) million or $(0.02) per Share, and $75.3 million or $0.57 per Share, respectively, during the six months ended June 30, 2025, and $132.7 million or $1.03 per Share, and $125.5 million or $0.97 per Share, respectively, during the six months ended June 30, 2024.

Reconciliation of Net Income Attributable to SUI Common Shareholders to NOI

(amounts in millions)

| Quarter Ended | Six Months Ended | ||||||||||||||

| June 30, 2025 | June 30, 2024 | June 30, 2025 | June 30, 2024 | ||||||||||||

| Net Income Attributable to SUI Common Shareholders | $ | 1,273.6 | $ | 52.1 | $ | 1,230.8 | $ | 24.7 | |||||||

| Interest income | (16.5 | ) | (5.2 | ) | (20.9 | ) | (9.7 | ) | |||||||

| Brokerage commissions and other revenues, net | (14.6 | ) | (10.4 | ) | (16.3 | ) | (12.4 | ) | |||||||

| General and administrative | 61.2 | 49.8 | 118.2 | 111.6 | |||||||||||

| Catastrophic event-related charges, net | 0.4 | 2.3 | 0.3 | 9.5 | |||||||||||

| Depreciation and amortization | 127.4 | 123.0 | 251.1 | 244.0 | |||||||||||

| Asset impairments(a) | 166.1 | 10.6 | 190.1 | 30.4 | |||||||||||

| Loss on extinguishment of debt | 102.4 | — | 102.4 | 0.6 | |||||||||||

| Interest expense | 58.2 | 89.8 | 140.3 | 179.5 | |||||||||||

| (Gain) / loss on foreign currency exchanges | (39.4 | ) | 2.8 | (48.1 | ) | 1.7 | |||||||||

| (Gain) / loss on disposition of properties | 1.3 | (2.5 | ) | 2.4 | (7.9 | ) | |||||||||

| Other (income) / expense, net(a) | (31.9 | ) | 1.1 | (37.6 | ) | 3.5 | |||||||||

| Loss on remeasurement of notes receivable | 1.4 | 0.4 | 1.6 | 1.1 | |||||||||||

| Income from nonconsolidated affiliates | (3.8 | ) | (3.0 | ) | (6.8 | ) | (4.4 | ) | |||||||

| (Gain) / loss on remeasurement of investment in nonconsolidated affiliates | 1.5 | (0.1 | ) | 1.5 | (5.3 | ) | |||||||||

| Current tax expense | 6.1 | 5.1 | 8.0 | 7.0 | |||||||||||

| Deferred tax benefit | (32.1 | ) | (3.7 | ) | (37.3 | ) | (9.4 | ) | |||||||

| Net income from discontinued operations, net | (1,422.5 | ) | (25.7 | ) | (1,404.0 | ) | (36.9 | ) | |||||||

| Add: Preferred return to preferred OP units / equity interests | 3.2 | 3.2 | 6.3 | 6.4 | |||||||||||

| Add: Income attributable to noncontrolling interests | 53.5 | 3.1 | 51.6 | 1.8 | |||||||||||

| NOI | $ | 295.5 | $ | 292.7 | $ | 533.6 | $ | 535.8 | |||||||

| Quarter Ended | Six Months Ended | ||||||||||

| June 30, 2025 | June 30, 2024 | June 30, 2025 | June 30, 2024 | ||||||||

| Real property NOI(a)(b) | $ | 263.6 | $ | 253.6 | $ | 490.0 | $ | 482.6 | |||

| Home sales NOI(a)(b) | 23.3 | 30.7 | 37.9 | 47.7 | |||||||

| Ancillary NOI(a)(b) | 8.6 | 8.4 | 5.7 | 5.5 | |||||||

| NOI | $ | 295.5 | $ | 292.7 | $ | 533.6 | $ | 535.8 | |||

(a) Refer to Definitions and Notes for additional information.

(b) Excludes properties classified as discontinued operations. During the quarter and six months ended June 30, 2025, the Company’s marina properties generated total NOI of $27.9 million and $92.0 million. During the quarter and six months ended June 30, 2024, the Company’s marina properties generated total NOI of $92.2 million and $153.8 million, respectively, which was recorded within Income from discontinued operations, net on the Consolidated Statements of Operations. Refer to the section “Assets Held for Sale and Discontinued Operations” within the Definitions and Notes for additional information.

Reconciliation of Net Income Attributable to SUI Common Shareholders to Recurring EBITDA

(amounts in millions)

| Quarter Ended | Six Months Ended | ||||||||||||||

| June 30, 2025 | June 30, 2024 | June 30, 2025 | June 30, 2024 | ||||||||||||

| Net Income Attributable to SUI Common Shareholders | $ | 1,273.6 | $ | 52.1 | $ | 1,230.8 | $ | 24.7 | |||||||

| Adjustments | |||||||||||||||

| Depreciation and amortization – continuing operations | 127.4 | 123.0 | 251.1 | 244.0 | |||||||||||

| Depreciation and amortization – discontinued operations | (0.3 | ) | 49.8 | 36.1 | 94.1 | ||||||||||

| Asset impairments – continuing operations(a) | 166.1 | 10.6 | 190.1 | 30.4 | |||||||||||

| Asset impairments – discontinued operations(a) | 0.2 | 1.0 | 2.3 | 1.9 | |||||||||||

| Loss on extinguishment of debt | 102.4 | — | 102.4 | 0.6 | |||||||||||

| Interest expense | 58.2 | 89.8 | 140.3 | 179.5 | |||||||||||

| Current tax expense – continuing operations | 6.1 | 5.1 | 8.0 | 7.0 | |||||||||||

| Current tax expense – discontinued operations | 0.3 | 0.2 | 0.6 | 0.4 | |||||||||||

| Deferred tax benefit | (32.1 | ) | (3.7 | ) | (37.3 | ) | (9.4 | ) | |||||||

| Income from nonconsolidated affiliates | (3.8 | ) | (3.0 | ) | (6.8 | ) | (4.4 | ) | |||||||

| Less: (Gain) / loss on dispositions of properties – continuing operations | 1.3 | (2.5 | ) | 2.4 | (7.9 | ) | |||||||||

| Less: Gain on dispositions of properties – discontinued operations | (1,445.0 | ) | — | (1,445.0 | ) | — | |||||||||

| Less: Gain on dispositions of assets, net | (4.0 | ) | (8.6 | ) | (7.9 | ) | (14.0 | ) | |||||||

| EBITDAre(a) | $ | 250.4 | $ | 313.8 | $ | 467.1 | $ | 546.9 | |||||||

| Adjustments | |||||||||||||||

| Transaction costs – discontinued operations(b) | 48.0 | N/A | 62.6 | N/A | |||||||||||

| Catastrophic event-related charges, net | 0.4 | 2.3 | 0.3 | 9.5 | |||||||||||

| Business combination expense – discontinued operations | — | 0.2 | — | 0.2 | |||||||||||

| (Gain) / loss on foreign currency exchanges | (39.4 | ) | 2.8 | (48.1 | ) | 1.7 | |||||||||

| Other (income) / expense, net – continuing operations(a) | (31.9 | ) | 1.1 | (37.6 | ) | 3.5 | |||||||||

| Other (income) / expense, net – discontinued operations(a) | 0.2 | 0.5 | 14.8 | (9.9 | ) | ||||||||||

| Loss on remeasurement of notes receivable | 1.4 | 0.4 | 1.6 | 1.1 | |||||||||||

| (Gain) / loss on remeasurement of investment in nonconsolidated affiliates | 1.5 | (0.1 | ) | 1.5 | (5.3 | ) | |||||||||

| Add: Preferred return to preferred OP units / equity interests | 3.2 | 3.2 | 6.3 | 6.4 | |||||||||||

| Add: Income attributable to noncontrolling interests | 53.5 | 3.1 | 51.6 | 1.8 | |||||||||||

| Add: Gain on dispositions of assets, net | 4.0 | 8.6 | 7.9 | 14.0 | |||||||||||

| Recurring EBITDA(a) | $ | 291.3 | $ | 335.9 | $ | 528.0 | $ | 569.9 | |||||||

(a) Refer to Definitions and Notes for additional information.

(b) Represents non-recurring transaction costs that are directly attributable to the Safe Harbor Sale.

Real Property Operations – Total Portfolio

(amounts in millions, except statistical information)

| Quarter Ended June 30, 2025 | Quarter Ended June 30, 2024 | ||||||||||||||||||||||||||||||

| Financial Information | MH | RV | UK | Total | MH | RV | UK | Total | |||||||||||||||||||||||

| Revenues | |||||||||||||||||||||||||||||||

| Real property (excluding transient)(a) | $ | 249.8 | $ | 85.5 | $ | 33.5 | $ | 368.8 | $ | 239.4 | $ | 80.6 | $ | 31.0 | $ | 351.0 | |||||||||||||||

| Real property – transient | 0.2 | 63.4 | 17.8 | 81.4 | 0.3 | 67.6 | 13.7 | 81.6 | |||||||||||||||||||||||

| Total operating revenues | 250.0 | 148.9 | 51.3 | 450.2 | 239.7 | 148.2 | 44.7 | 432.6 | |||||||||||||||||||||||

| Expenses | |||||||||||||||||||||||||||||||

| Property operating expenses | 81.4 | 76.0 | 29.2 | 186.6 | 79.0 | 74.0 | 26.0 | 179.0 | |||||||||||||||||||||||

| Real Property NOI(a) | $ | 168.6 | $ | 72.9 | $ | 22.1 | $ | 263.6 | $ | 160.7 | $ | 74.2 | $ | 18.7 | $ | 253.6 | |||||||||||||||

| Six Months Ended June 30, 2025 | Six Months Ended June 30, 2024 | ||||||||||||||||||||||||||||||

| Financial Information | MH | RV | UK | Total | MH | RV | UK | Total | |||||||||||||||||||||||

| Revenues | |||||||||||||||||||||||||||||||

| Real property (excluding transient)(a) | $ | 498.6 | $ | 159.3 | $ | 64.8 | $ | 722.7 | $ | 477.0 | $ | 150.6 | $ | 66.4 | $ | 694.0 | |||||||||||||||

| Real property – transient | 0.7 | 91.5 | 19.7 | 111.9 | 0.7 | 102.1 | 16.3 | 119.1 | |||||||||||||||||||||||

| Total operating revenues | 499.3 | 250.8 | 84.5 | 834.6 | 477.7 | 252.7 | 82.7 | 813.1 | |||||||||||||||||||||||

| Expenses | |||||||||||||||||||||||||||||||

| Property operating expenses | 158.2 | 133.2 | 53.2 | 344.6 | 154.4 | 127.3 | 48.8 | 330.5 | |||||||||||||||||||||||

| Real Property NOI | $ | 341.1 | $ | 117.6 | $ | 31.3 | $ | 490.0 | $ | 323.3 | $ | 125.4 | $ | 33.9 | $ | 482.6 | |||||||||||||||

| As of June 30, 2025 | As of June 30, 2024 | ||||||||||||||||||||||||||||||

| Other Information | MH | RV | UK | Total | MH | RV | UK | Total | |||||||||||||||||||||||

| Number of Properties | 284 | 164 | 53 | 501 | 295 | 180 | 54 | 529 | |||||||||||||||||||||||

| Sites | |||||||||||||||||||||||||||||||

| Sites(b) | 97,380 | 32,100 | 17,510 | 146,990 | 100,160 | 33,590 | 17,710 | 151,460 | |||||||||||||||||||||||

| Transient sites | N/A | 23,440 | 4,020 | 27,460 | N/A | 25,720 | 4,580 | 30,300 | |||||||||||||||||||||||

| Total | 97,380 | 55,540 | 21,530 | 174,450 | 100,160 | 59,310 | 22,290 | 181,760 | |||||||||||||||||||||||

| Occupancy | 97.4 | % | 100.0 | % | 90.3 | % | 97.1 | % | 96.7 | % | 100.0 | % | 89.9 | % | 96.7 | % | |||||||||||||||

N/A = Not applicable.

(a) Refer to Definitions and Notes for additional information.

(b) MH annual sites included 11,946 and 10,589 rental homes in the Company’s rental program at June 30, 2025 and 2024, respectively. The Company’s investment in occupied rental homes at June 30, 2025 was $812.5 million, an increase of 14.5% from $709.4 million at June 30, 2024.

Real Property Operations – North America Same Property Portfolio(a)

(amounts in millions, except for statistical information)

| Quarter Ended June 30, 2025 | Quarter Ended June 30, 2024 | Total Change | % Change(d) | |||||||||||||||||||||||||||

| MH(b) | RV(b) | Total | MH(b) | RV(b) | Total | MH | RV | Total | ||||||||||||||||||||||

| Financial Information | ||||||||||||||||||||||||||||||

| Same Property Revenues | ||||||||||||||||||||||||||||||

| Real property (excluding transient) | $ | 231.0 | $ | 77.8 | $ | 308.8 | $ | 216.1 | $ | 72.2 | $ | 288.3 | $ | 20.5 | 6.9 | % | 7.7 | % | 7.1 | % | ||||||||||

| Real property – transient | 0.2 | 60.0 | 60.2 | 0.3 | 64.3 | 64.6 | (4.4 | ) | (43.9) % | (6.7) % | (6.8) % | |||||||||||||||||||

| Total Same Property operating revenues | 231.2 | 137.8 | 369.0 | 216.4 | 136.5 | 352.9 | 16.1 | 6.9 | % | 0.9 | % | 4.6 | % | |||||||||||||||||

| Same Property Expenses | ||||||||||||||||||||||||||||||

| Same Property operating expenses(e)(f) | 63.1 | 66.8 | 129.9 | 60.3 | 64.8 | 125.1 | 4.8 | 4.7 | % | 3.1 | % | 3.9 | % | |||||||||||||||||

| Real Property NOI(a) | $ | 168.1 | $ | 71.0 | $ | 239.1 | $ | 156.1 | $ | 71.7 | $ | 227.8 | $ | 11.3 | 7.7 | % | (1.1) % | 4.9 | % | |||||||||||

| Six Months Ended June 30, 2025 | Six Months Ended June 30, 2024 | Total Change | % Change(d) | |||||||||||||||||||||||||||

| MH(b) | RV(b) | Total | MH(b) | RV(b) | Total | MH | RV | Total | ||||||||||||||||||||||

| Financial Information | ||||||||||||||||||||||||||||||

| Same Property Revenues | ||||||||||||||||||||||||||||||

| Real property (excluding transient) | $ | 458.6 | $ | 145.2 | $ | 603.8 | $ | 428.1 | $ | 134.8 | $ | 562.9 | $ | 40.9 | 7.1 | % | 7.7 | % | 7.3 | % | ||||||||||

| Real property – transient | 0.7 | 86.3 | 87.0 | 0.7 | 97.4 | 98.1 | (11.1 | ) | (4.7) % | (11.4) % | (11.4) % | |||||||||||||||||||

| Total Same Property operating revenues | 459.3 | 231.5 | 690.8 | 428.8 | 232.2 | 661.0 | 29.8 | 7.1 | % | (0.3) % | 4.5 | % | ||||||||||||||||||

| Same Property Expenses | ||||||||||||||||||||||||||||||

| Same Property operating expenses(e)(f) | 119.5 | 115.8 | 235.3 | 115.1 | 111.2 | 226.3 | 9.0 | 3.8 | % | 4.1 | % | 3.9 | % | |||||||||||||||||

| Real Property NOI(a) | $ | 339.8 | $ | 115.7 | $ | 455.5 | $ | 313.7 | $ | 121.0 | $ | 434.7 | $ | 20.8 | 8.3 | % | (4.3) % | 4.8 | % | |||||||||||

| Other Information | ||||||||||||||||||||||||||||||

| Number of properties | 281 | 156 | 437 | 281 | 156 | 437 | ||||||||||||||||||||||||

| Sites | 96,900 | 53,380 | 150,280 | 96,810 | 53,390 | 150,200 | ||||||||||||||||||||||||

(a) Refer to Definitions and Notes for additional information.

(b) Same Property results for the Company’s MH and RV properties reflect constant currency for comparative purposes. Canadian currency figures in the prior comparative period have been translated at the average exchange rate of $0.7227 USD and $0.7096 per Canadian dollar, respectively, during the quarter and six months ended June 30, 2025.

(c) Financial results from properties impacted by dispositions and catastrophic weather events during 2024 have been removed from Same Property reporting.

(d) Percentages are calculated based on unrounded numbers.

(e) Refer to “Utility Revenues” within Definitions and Notes for additional information.

(f) Total Same Property operating expenses consist of the following components for the periods shown (in millions) and exclude amounts invested into recently acquired properties to bring them up to the Company’s standards:

| Quarter Ended | Six Months Ended | ||||||||||||||||||||||||

| June 30, 2025 | June 30, 2024 | Change | % Change(d) | June 30, 2025 | June 30, 2024 | Change | % Change(c) | ||||||||||||||||||

| Payroll and benefits | $ | 38.8 | $ | 38.6 | $ | 0.2 | 0.5 | % | $ | 68.8 | $ | 68.9 | $ | (0.1 | ) | (0.2) % | |||||||||

| Real estate taxes | 26.0 | 23.5 | 2.5 | 10.7 | % | 50.1 | 46.3 | 3.8 | 8.2 | % | |||||||||||||||

| Supplies and repairs | 20.6 | 19.1 | 1.5 | 7.5 | % | 35.5 | 32.4 | 3.1 | 9.7 | % | |||||||||||||||

| Utilities | 17.2 | 17.5 | (0.3 | ) | (1.9) % | 33.3 | 31.2 | 2.1 | 6.6 | % | |||||||||||||||

| Legal, state / local taxes, and insurance | 10.9 | 12.5 | (1.6 | ) | (12.6) % | 21.4 | 24.1 | (2.7 | ) | (11.4) % | |||||||||||||||

| Other | 16.4 | 13.9 | 2.5 | 18.7 | % | 26.2 | 23.4 | 2.8 | 11.9 | % | |||||||||||||||

| Total Same Property Operating Expenses | $ | 129.9 | $ | 125.1 | $ | 4.8 | 3.9 | % | $ | 235.3 | $ | 226.3 | $ | 9.0 | 3.9 | % | |||||||||

| As of | ||||||||||||||||

| June 30, 2025 | June 30, 2024 | |||||||||||||||

| MH | RV | MH | RV | |||||||||||||

| Other Information | ||||||||||||||||

| Number of properties(b) | 281 | 156 | 281 | 156 | ||||||||||||

| Sites | ||||||||||||||||

| MH and annual RV sites | 96,900 | 31,150 | 96,810 | 30,250 | ||||||||||||

| Transient RV sites | N/A | 22,230 | N/A | 23,140 | ||||||||||||

| Total | 96,900 | 53,380 | 96,810 | 53,390 | ||||||||||||

| MH and Annual RV Occupancy | ||||||||||||||||

| Occupancy(c) | 97.6 | % | 100.0 | % | 97.0 | % | 100.0 | % | ||||||||

| Average monthly base rent per site | $ | 730 | $ | 677 | $ | 693 | $ | 645 | ||||||||

| % Change of monthly base rent(d) | 5.3 | % | 5.0 | % | N/A | N/A | ||||||||||

| Rental Program Statistics included in MH | ||||||||||||||||

| Number of occupied sites, end of period(e) | 11,380 | N/A | 10,170 | N/A | ||||||||||||

| Monthly rent per site – MH rental program | $ | 1,363 | N/A | $ | 1,328 | N/A | ||||||||||

| % Change(d) | 2.7 | % | N/A | N/A | N/A | |||||||||||

N/A = Not applicable.

(a) Refer to Definitions and Notes for additional information.

(b) Financial results from properties impacted by dispositions and catastrophic weather events during 2024 have been removed from Same Property reporting.

(c) Same Property blended occupancy for MH and RV was 98.2% at June 30, 2025, up 50 basis points from 97.7% at June 30, 2024. Adjusting for recently delivered and vacant expansion sites, Same Property adjusted blended occupancy for MH and RV increased by 150 basis points year over year, to 99.0% at June 30, 2025, from 97.5% at June 30, 2024.

(d) Calculated using actual results without rounding.

(e) Occupied rental program sites in Same Property are included in total sites.

Real Property Operations – UK Same Property Portfolio(a)

(amounts in millions, except for statistical information)

| Quarter Ended | Six Months Ended | ||||||||||||||||

| June 30, 2025 | June 30, 2024 | % Change(c) | June 30, 2025 | June 30, 2024 | % Change(c) | ||||||||||||

| Financial Information(b) | |||||||||||||||||

| Same Property Revenues | |||||||||||||||||

| Real property (excluding transient) | $ | 27.2 | $ | 26.0 | 4.7 | % | $ | 52.5 | $ | 50.4 | 4.1 | % | |||||

| Real property – transient | 17.0 | 14.4 | 18.3 | % | 18.8 | 17.0 | 10.8 | % | |||||||||

| Total Same Property operating revenues | 44.2 | 40.4 | 9.5 | % | 71.3 | 67.4 | 5.8 | % | |||||||||

| Same Property Expenses | |||||||||||||||||

| Same Property operating expenses(a) | 21.1 | 19.4 | 8.8 | % | 38.1 | 35.8 | 6.5 | % | |||||||||

| Real Property NOI(a) | $ | 23.1 | $ | 21.0 | 10.2 | % | $ | 33.2 | $ | 31.6 | 5.0 | % | |||||

| As of | ||||||||

| June 30, 2025 | June 30, 2024 | |||||||

| Other Information | ||||||||

| Number of properties | 51 | 51 | ||||||

| Sites | ||||||||

| UK sites | 16,730 | 16,670 | ||||||

| UK transient sites | 3,430 | 3,530 | ||||||

| Occupancy(d) | 90.5 | % | 90.2 | % | ||||

| Average monthly base rent per site | $ | 584 | $ | 554 | ||||

| % change in monthly base rent(c) | 5.3 | % | N/A | |||||

(a) Refer to Definitions and Notes for additional information.

(b) Same Property results for the Company’s UK properties reflect constant currency for comparative purposes. British pound sterling figures in the prior comparative period have been translated at the average exchange rate of $1.3359 and $1.2973 USD per pound sterling, respectively, during the quarter and six months ended June 30, 2025.

(c) Percentages are calculated based on unrounded numbers.

(d) Adjusting for recently delivered and vacant expansion sites, Same Property adjusted occupancy decreased by 40 basis points year over year, to 90.6% at June 30, 2025, from 91.0% at June 30, 2024.

Home Sales Summary

($ in millions, except for average selling price)

| Quarter Ended | Six Months Ended | ||||||||||||||||||||

| June 30, 2025 | June 30, 2024 | % Change | June 30, 2025 | June 30, 2024 | % Change | ||||||||||||||||

| Financial Information | |||||||||||||||||||||

| North America | |||||||||||||||||||||

| Home sales | $ | 41.8 | $ | 58.2 | (28.2) % | $ | 70.5 | $ | 91.0 | (22.5) % | |||||||||||

| Home cost and selling expenses | 35.0 | 45.0 | (22.2) % | 59.5 | 71.2 | (16.4) % | |||||||||||||||

| NOI(a) | $ | 6.8 | $ | 13.2 | (48.5) % | $ | 11.0 | $ | 19.8 | (44.4) % | |||||||||||

| NOI margin %(a) | 16.3 | % | 22.7 | % | 15.6 | % | 21.8 | % | |||||||||||||

| UK | |||||||||||||||||||||

| Home sales | $ | 58.3 | $ | 49.3 | 18.3 | % | $ | 96.8 | $ | 85.4 | 13.3 | % | |||||||||

| Home cost and selling expenses | 41.8 | 31.8 | 31.4 | % | 69.9 | 57.5 | 21.6 | % | |||||||||||||

| NOI(a) | $ | 16.5 | $ | 17.5 | (5.7) % | $ | 26.9 | $ | 27.9 | (3.6) % | |||||||||||

| NOI margin %(a) | 28.3 | % | 35.5 | % | 27.8 | % | 32.7 | % | |||||||||||||

| Total | |||||||||||||||||||||

| Home sales | $ | 100.1 | $ | 107.5 | (6.9) % | $ | 167.3 | $ | 176.4 | (5.2) % | |||||||||||

| Home cost and selling expenses | 76.8 | 76.8 | — | % | 129.4 | 128.7 | 0.5 | % | |||||||||||||

| NOI(a) | $ | 23.3 | $ | 30.7 | (24.1) % | $ | 37.9 | $ | 47.7 | (20.5) % | |||||||||||

| NOI margin %(a) | 23.3 | % | 28.6 | % | 22.7 | % | 27.0 | % | |||||||||||||

| Other information | |||||||||||||||||||||

| Units Sold: | |||||||||||||||||||||

| North America | 480 | 623 | (23.0) % | 827 | 950 | (12.9) % | |||||||||||||||

| UK | 805 | 787 | 2.3 | % | 1,419 | 1,408 | 0.8 | % | |||||||||||||

| Total home sales | 1,285 | 1,410 | (8.9) % | 2,246 | 2,358 | (4.7) % | |||||||||||||||

| Average Selling Price: | |||||||||||||||||||||

| North America | $ | 87,083 | $ | 93,419 | (6.8) % | $ | 85,248 | $ | 95,789 | (11.0) % | |||||||||||

| UK | $ | 72,422 | $ | 62,643 | 15.6 | % | $ | 68,217 | $ | 60,653 | 12.5 | % | |||||||||

(a) Refer to Definitions and Notes for additional information.

Operating Statistics for MH and Annual RVs

| Resident Move-outs | |||||||||||||

| % of Total Sites | Number of Move-outs | Leased Sites, Net(b) | New Home Sales | Pre-owned Home Sales | Brokered Re-sales |

||||||||

| 2025 – YTD as of June 30 | 4.2 | % | (a) | 5,698 | 474 | 173 | 654 | 824 | |||||

| 2024 | 4.3 | % | 7,050 | 3,209 | 447 | 1,554 | 1,700 | ||||||

| 2023 | 3.6 | % | 6,590 | 3,268 | 564 | 2,001 | 2,296 | ||||||

(a) Percentage calculated on a trailing 12-month basis.

(b) Increase in revenue producing sites, net of new vacancies.

Acquisitions and Dispositions

(amounts in millions, except for *)

| Property Name | Property Type | Number of Properties* | Sites, Wet Slips and Dry Storage Spaces* | State, Province or Country | Total Purchase Price / Sales Proceeds | Month | |||||||

| DISPOSITIONS | |||||||||||||

| First Quarter 2025 | |||||||||||||

| RV Portfolio(a) | RV | 2 | 815 | Various | $ | 92.9 | January | ||||||

| MH Portfolio | MH | 3 | 136 | FL | 27.8 | March | |||||||

| Second Quarter 2025 | |||||||||||||

| Sun Retreats Millbrook | RV | 1 | 394 | IL | 3.5 | April | |||||||

| Safe Harbor Marinas – Initial Closing | Marina | 123 | 43,143 | Various | 5,250.0 | April | |||||||

| Safe Harbor Marinas – Delayed Consent Subsidiaries | Marina | 6 | 1,770 | Various | 136.7 | May / June | |||||||

| Total Dispositions to Date | 135 | 46,258 | $ | 5,510.9 | |||||||||

(a) Total sales proceeds include the disposition of two operating properties and two development properties that were owned by the Company along with the settlement of a developer note receivable of $36.5 million pertaining to three additional properties in which the Company had provided financing to the developer.

Capital Expenditures and Investments(a)

(amounts in millions)

| Six Months Ended | Year Ended | |||||||||||||||||||||||||

| June 30, 2025 | December 31, 2024 | December 31, 2023 | ||||||||||||||||||||||||

| MH / RV | UK | Total | MH / RV | UK | Total | MH / RV | UK | Total | ||||||||||||||||||

| Recurring Capital Expenditures(b) | $ | 22.1 | $ | 5.7 | $ | 27.8 | $ | 54.5 | $ | 13.5 | $ | 68.0 | $ | 51.8 | $ | — | $ | 51.8 | ||||||||

| Non-Recurring Capital Expenditures(b) | ||||||||||||||||||||||||||

| Lot Modifications | $ | 17.0 | $ | 1.2 | $ | 18.2 | $ | 35.5 | $ | 1.7 | $ | 37.2 | $ | 54.9 | $ | — | $ | 54.9 | ||||||||

| Growth Projects | 5.9 | 1.3 | 7.2 | 11.5 | 4.8 | 16.3 | 21.6 | — | 21.6 | |||||||||||||||||

| Rebranding | — | 0.5 | 0.5 | — | 3.1 | 3.1 | 4.7 | — | 4.7 | |||||||||||||||||

| Acquisitions | 5.1 | 4.5 | 9.6 | 36.2 | 13.5 | 49.7 | 115.1 | 67.3 | 182.4 | |||||||||||||||||

| Expansion and Development | 37.5 | 12.2 | 49.7 | 105.2 | 17.8 | 123.0 | 247.4 | 2.9 | 250.3 | |||||||||||||||||

| Total Non-Recurring Capital Expenditures | 65.5 | 19.7 | 85.2 | 188.4 | 40.9 | 229.3 | 443.7 | 70.2 | 513.9 | |||||||||||||||||

| Total | $ | 87.6 | $ | 25.4 | $ | 113.0 | $ | 242.9 | $ | 54.4 | $ | 297.3 | $ | 495.5 | $ | 70.2 | $ | 565.7 | ||||||||

(a) Represents capital expenditures and investments related to the Company’s continuing operations and excludes activity related to Safe Harbor Marinas, which is classified within discontinued operations.

(b) Refer to Definitions and Notes for additional information.

Capitalization Overview

(Shares and units in thousands, dollar amounts in millions, except for *)

| As of June 30, 2025 | |||||||||

| Common Equivalent Shares | Share Price* | Capitalization | |||||||

| Equity and Enterprise Value | |||||||||

| Common shares | 125,858 | $ | 126.49 | $ | 15,919.8 | ||||

| Convertible securities | |||||||||

| Common OP units | 2,823 | $ | 126.49 | 357.1 | |||||

| Preferred OP units | 2,406 | $ | 126.49 | 304.3 | |||||

| Diluted shares outstanding and market capitalization(a) | 131,087 | 16,581.2 | |||||||

| Plus: Total debt, per consolidated balance sheet | 4,283.5 | ||||||||

| Total capitalization | 20,864.7 | ||||||||

| Less: Cash and cash equivalents (excluding restricted cash) – continuing operations | (889.8 | ) | |||||||

| Less: Cash and cash equivalents (excluding restricted cash) – discontinued operations | (4.1 | ) | |||||||

| Enterprise Value(b) | $ | 19,970.8 | |||||||

| Weighted Average Maturity (in years)* |

Debt Outstanding | ||||||||

| Debt | |||||||||

| Mortgage loans payable | 9.0 | $ | 2,451.6 | ||||||

| Secured borrowings on collateralized receivables(c) | 12.8 | 46.6 | |||||||

| Unsecured debt | 5.6 | 1,785.3 | |||||||

| Total carrying value of debt, per consolidated balance sheet | 7.6 | 4,283.5 | |||||||

| Plus: Unamortized deferred financing costs and discounts / premiums on debt | 21.8 | ||||||||

| Total Debt | $ | 4,305.3 | |||||||

| Corporate Debt Rating and Outlook | |||||||||

| Moody’s | Baa2 | Stable | ||||||||

| S&P | BBB+ | Stable | ||||||||

(a) Refer to “Securities” within Definitions and Notes for additional information related to the Company’s securities outstanding.

(b) Refer to “Enterprise Value” and “Net Debt” within Definitions and Notes for additional information.

(c) Refer to “Secured borrowings on collateralized receivables” within Definitions and Notes for additional information.

(d)

Summary of Outstanding Debt

(amounts in millions, except for *)

| Quarter Ended | ||||||||

| June 30, 2025 | ||||||||

| Debt Outstanding | Weighted Average Interest Rate(a)* | Maturity Date* | ||||||

| Secured Debt: | ||||||||

| Mortgage loans payable | $ | 2,451.6 | 3.64 | % | Various | |||

| Secured borrowings on collateralized receivables(b) | 46.6 | 8.55 | % | Various | ||||

| Total Secured Debt | 2,498.2 | 3.73 | % | |||||

| Unsecured Debt: | ||||||||

| Senior Unsecured Notes: | ||||||||

| 2028 senior unsecured notes | 447.8 | 2.29 | % | November 2028 | ||||

| 2031 senior unsecured notes | 743.9 | 2.70 | % | July 2031 | ||||

| 2032 senior unsecured notes | 593.6 | 3.61 | % | April 2032 | ||||

| Total Unsecured Debt | 1,785.3 | 2.90 | % | |||||

| Total carrying value of debt, per consolidated balance sheets | 4,283.5 | 3.38 | % | |||||

| Plus: Unamortized deferred financing costs, discounts / premiums on debt, and fair value adjustments(a) | 21.8 | |||||||

| Total debt | $ | 4,305.3 | ||||||

(a) Includes the effect of amortizing deferred financing costs, unsecured note discounts, and fair value adjustments on the Secured borrowings on collateralized receivables.

(b) Refer to “Secured borrowings on collateralized receivables” within Definitions and Notes for additional information.

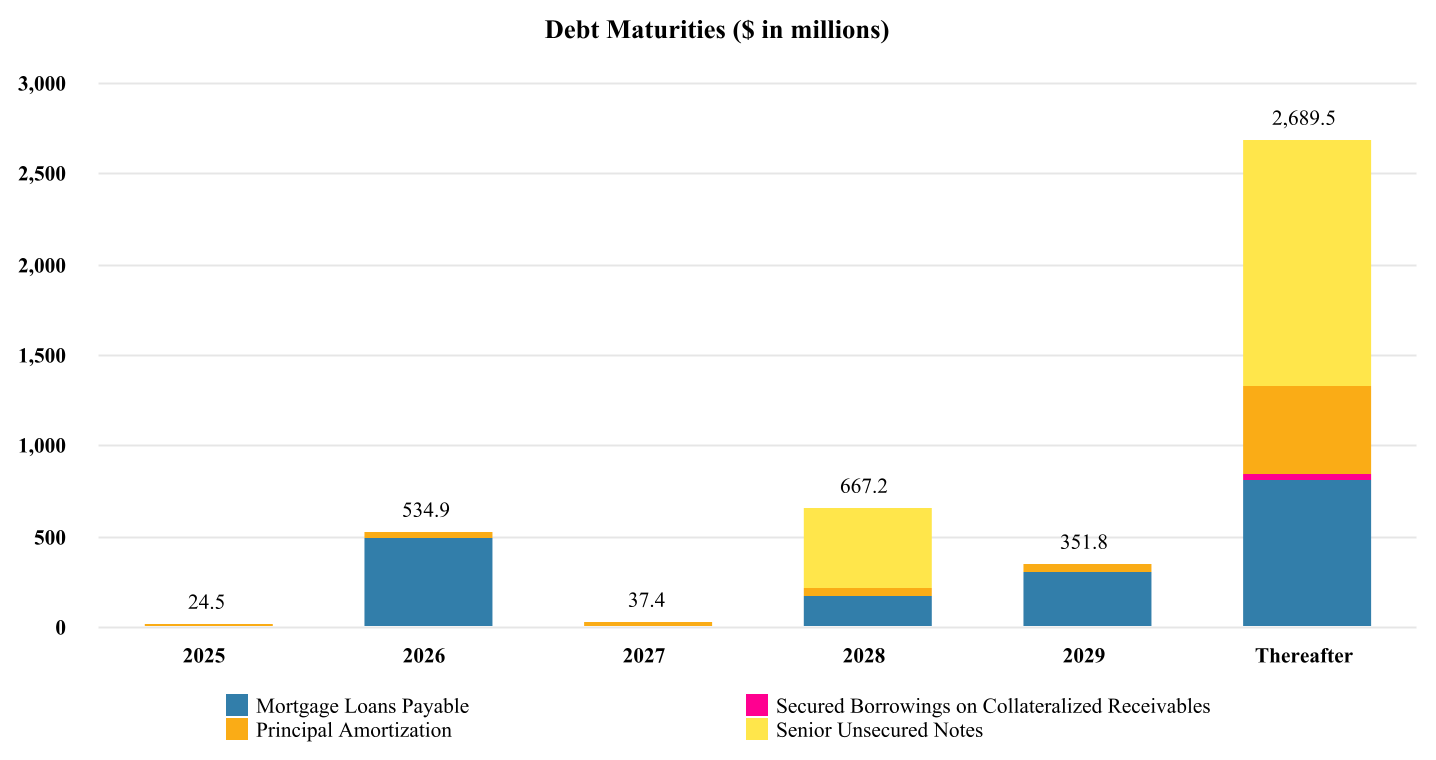

Debt Maturities(a)

(amounts in millions, except for *)

| As of | |||||||||||||||

| June 30, 2025 | |||||||||||||||

| Year | Mortgage Loans Payable(b) | Principal Amortization | Secured Borrowings on Collateralized Receivables(c)(d) | Senior Unsecured Notes |

Total | ||||||||||

| 2025 | $ | — | $ | 23.4 | $ | 1.1 | $ | — | $ | 24.5 | |||||

| 2026 | 492.0 | 40.6 | 2.3 | — | 534.9 | ||||||||||

| 2027 | — | 34.9 | 2.5 | — | 37.4 | ||||||||||

| 2028 | 175.7 | 38.8 | 2.7 | 450.0 | 667.2 | ||||||||||

| 2029 | 310.7 | 38.2 | 2.9 | — | 351.8 | ||||||||||

| Thereafter | 815.8 | 492.1 | 31.6 | 1,350.0 | 2,689.5 | ||||||||||

| Total | $ | 1,794.2 | $ | 668.0 | $ | 43.1 | $ | 1,800.0 | $ | 4,305.3 | |||||

(a) Debt maturities include the unamortized deferred financing costs, discount / premiums, and fair value adjustments associated with outstanding debt.

(b) For the Mortgage loans payable maturing between 2025 – 2029:

| 2025 | 2026 | 2027 | 2028 | 2029 | ||||||||||

| Weighted average interest rate | — | % | 3.76 | % | — | % | 3.97 | % | 3.16 | % |

(c) Balance at June 30, 2025 excludes fair value adjustments of $3.5 million.

(d) Refer to “Secured borrowings on collateralized receivables” within Definitions and Notes for additional information.

Debt Analysis

| As of | |||||

| June 30, 2025 | |||||

| Select Credit Ratios | |||||

| Net Debt / TTM Recurring EBITDA(a) | 2.9 x | ||||

| Net Debt / Enterprise Value(a) | 17.0 | % | |||

| Net Debt / Gross Assets(a) | 20.1 | % | |||

| Unencumbered Assets / Total Assets | 80.7 | % | |||

| Floating rate debt / total debt(b) | N/A(c) | ||||

| Coverage Ratios | |||||

| TTM Recurring EBITDA(a)(b) / Interest | 3.8 x | ||||

| TTM Recurring EBITDA(a)(b) / Interest + Preferred distributions + Preferred stock distribution | 3.8 x | ||||

| Senior Credit Facility Covenants(d) | Requirement | ||||

| Maximum leverage ratio | <65.0 % | 17.9 | % | ||

| Minimum fixed charge coverage ratio | >1.40 x | 3.25 x | |||

| Maximum secured leverage ratio | <40.0 % | 11.3 | % | ||

| Senior Unsecured Note Covenants | Requirement | ||||

| Total debt / Total assets | ≤60.0 % | 26.0 | % | ||

| Secured debt / Total assets | ≤40.0 % | 15.1 | % | ||

| Consolidated income available for debt service / Debt service | ≥1.50 x | 7.48 x | |||

| Unencumbered total asset value / Total unsecured debt | ≥150.0 % | 743.9 | % | ||

(a) Refer to Definitions and Notes for additional information.

(b) Percentage includes the impact of hedge activities.

(c) As of June 30, 2025, the Company has no floating rate debt.

(d) As of June 30, 2025, the Company did not have any borrowings outstanding under the senior credit facility.

Definitions and Notes

Acquisition and Other Transaction Costs – In the Company’s Reconciliation of Net Income Attributable to SUI Common Shareholders to Core FFO on page 6, ‘Acquisition and other transaction costs – continuing operations’ represent (a) nonrecurring integration expenses associated with acquisitions during the quarter and six months ended June 30, 2025 and 2024, (b) costs associated with potential acquisitions that will not close, (c) expenses incurred to bring recently acquired properties up to the Company’s operating standards, including items such as tree trimming and painting costs that do not meet the Company’s capitalization policy, and (d) other non-recurring transaction costs. Within this same reconciliation on page 6, ‘Acquisition and other transaction costs – discontinued operations’ primarily represent non-recurring transaction costs that are directly attributable to the Safe Harbor Sale and nonrecurring integration expenses associated with acquisitions.

Asset Impairments – In the Company’s Consolidated Statements of Operations on page 5, the Company recorded asset impairment charges of $166.1 million for the quarter ended June 30, 2025, consisting of asset impairment charges of $132.7 million to reduce the carrying value of three development properties in the UK, and asset impairment charges of $32.2 million to reduce the carrying value of three RV properties in the US and Canada, in each case driven by the Company’s contemplated change in strategic plan for these properties.

Assets Held for Sale and Discontinued Operations – In February 2025, the Company entered into the Safe Harbor Sale, which represents a strategic shift in operations that is expected to have a major effect on the Company’s operations and financial results. Accordingly, the results of the Marina business and assets and liabilities included in the disposition are presented as held for sale and as discontinued operations for all periods presented herein.