- Clean, 100% title: Super Copper to acquire outright ownership with no royalties, back-ins or encumbrances, preserving full project economics.

- Low entry cost, success-linked upside, and zero share dilution: US $100k at closing, no share dilution; further cash only by milestones such as a significant drill intercept, a Preliminary Economic Assessment with ≥$50M NPV, or first commercial sale from production.

- Past–producing neighbourhood: records indicate that roughly 1.3 Mt averaging 1.2% acid-soluble Cu were trucked from Manto Negro Mine to Pucobre’s nearby Biocobre SX-EW plant between 2005 and 2009, providing a processing analogue for Castilla*.

- Developed infrastructure and access: Located 5 km from the Pan-American Highway and a high-voltage power corridor, with SX-EW facilities within 70 km, enabling low-capital development scenarios.

VANCOUVER, BC, July 8, 2025 /CNW/ – SUPER COPPER CORP. (CSE: CUPR) (OTCQB: CUPPF) (FSE: N60) (“Super Copper” or the “Company“), is pleased to announce it has entered into a binding, all-cash definitive agreement to acquire 100% of the Castilla Copper Project (“Castilla” or the “Castilla Project“) from Verdant Resources SpA, a private Chilean company comprised of geologists and mining professionals.

Castilla Copper Project:

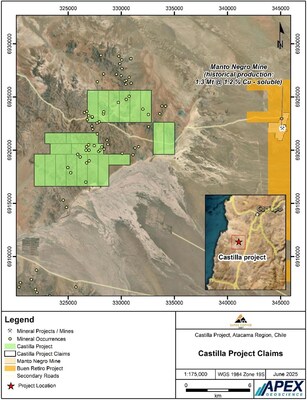

The Castilla Project is a 5,800-hectare package of twenty exploration concessions located in Chile’s Atacama Region. The Project lies within the north/northeast Atacama fault system trend, along with the nearby and parallel historic Manto Negro open pit copper mine (“Manto Negro“) trend. Government records indicate that there are several mineral occurrences within the Project boundaries. Castilla lies on the same northeast and northwest-southeast structural corridor as the historic Manto Negro, which produced approximately 1.3 million tonnes (Mt) of 1.2% soluble copper between 2005 and 2009 (Source Jobin-Bevans, 2024)*. Manto Negro is an example of near surface oxide copper mineralization that is nearby and may or may not be indicative of mineralization on the Castilla Project. There are a number of historical artisanal workings on the Project lands and occurrences (Figure 1) but the Company has yet to conduct sampling.

Key Highlights:

- 100% outright ownership, no royalties: Super Copper will hold the Castilla concessions free and clear of any net-smelter return (“NSR“) or back-in rights.

- Potential metallurgical analogue: Castilla covers the untested western fault block of the breccia horizon exploited at Manto Negro, where copper was recovered by straightforward heap-leach/SX-EW processing.

- Exploration Opportunity: A property visit has confirmed the presence of artisanal mine workings and the presence of anomalous copper, gold, and silver. Reconnaissance samples have yet to be collected by Super Copper; the ground has never been drilled.

- Capital-efficient entry: Cash consideration of US $100,000 on closing; additional cash is payable only upon discovery drilling success, delivery of a positive Preliminary Economic Assessment (“PEA“) of ≥US$50 million Net Present Value (“NPV“), and achievement of first commercial sale from production.

- Logistical synergies: Castilla sits ~65 km by paved road from Copiapó and ~95 km from Super Copper’s Cordillera Cobre project, allowing shared personnel, contractors and permitting resources.

Zachary Dolesky, Chief Executive Officer of Super Copper, stated: “Castilla offers an exceptional risk-reward profile: we secure 5,800 hectares on a copper-oxide trend for a small upfront fee with all future payments tied to genuine discovery and development milestones. The historical record at the neighbouring Manto Negro pit provides a processing template, while the proximity to Cordillera Cobre lets us stretch each exploration dollar further. We believe Castilla has the potential to deliver results once drilled, and we are eager to begin work.”

Location and Setting:

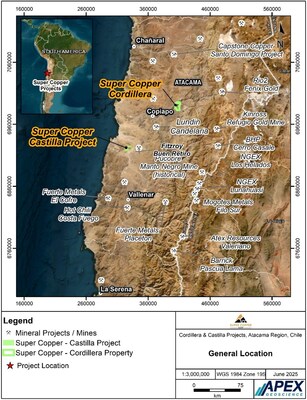

The Castilla Project is situated approximately 65 km southwest of Copiapó in Chile’s northern Atacama Region (see Figure 1). This part of the Atacama hosts the well-known Punta del Cobre iron-oxide copper–gold (IOCG) belt, a 20 km-long, 5 km-wide corridor containing a cluster of IOCG and manto-style deposits of various sizes. Major operations within the belt include Alcaparrosa, Carola, Española, Punta del Cobre, Santos, Socavón Rampa and Trinidad, while Lundin Mining’s Candelaria complex lies ~50 km to the northeast.

Infrastructure is excellent, the Pan-American Highway and a high-voltage power corridor pass just 5 km east of the property, Copiapó’s rail spur lies 60 km to the north, and multiple SX-EW facilities operate within trucking distance.

Topography across Castilla is gently undulating desert with thin gravel cover at an average elevation of about 375 m, allowing year-round exploration with minimal environmental and community footprint.

Transaction Terms:

|

Milestone |

Trigger |

Cash to |

Timing |

|

(a) Closing |

100% title transfers to Super Copper; no |

$100,000 |

Payable on closing date. |

|

(b) |

First drill hole intercept that is: |

$50,000 |

Payable within 15 days of |

|

(c) PEA |

Positive NI 43-101 PEA with after-tax |

$150,000 |

Payable within 30 days of |

|

(d) |

First commercial sale of concentrate or |

$1,000,000 |

Payable within 30 days of |

Pursuant to the binding definitive agreement, the Project is to be acquired by the Company through its recently incorporated Chilean subsidiary. Closing of the acquisition is subject to due diligence by the Company, Canadian Securities Exchange approval (if required), standard closing deliverables and other customary conditions typical for a transaction of this nature. The closing of the acquisition is currently expected to occur on or about July 21, 2025.

Strategic Rationale:

Upon closing of the acquisition, Super Copper will hold ownership of two complementary projects in Chile:

- Castilla Project – near-surface, heap-leach style mineralisation offering rapid, lower-capital potential; and

- Cordillera Cobre Project – a larger sulphide target advancing through Phase 2 geophysics in 2025.

With both assets located within a less than 100 km radius, the Company will deploy a single exploration team and shared service contracts, potentially reducing per-metre costs and accelerating decision timelines (Figure 2).

Planned Work Programme

Super Copper is evaluating a work programme for the Castilla Project. The Company is working closely with its geological team, consultants, technology providers, and execution partners to establish the plan, and will issue an update subsequently.

About Super Copper Corp.

Super Copper (CSE: CUPR | OTCQB: CUPPF | FSE: N60) is an exploration company focused on acquiring, advancing and consolidating global copper assets from early discovery through late-stage development. The company is currently advancing its copper projects in Atacama, Chile, a region with world-class infrastructure and the presence of global majors. By operating a single, integrated technical team and a milestone-driven acquisition strategy, Super Copper aims to build a portfolio of scalable projects capable of supplying the world’s accelerating demand for copper. | www.supercopper.com

The technical content of this news release has been reviewed and approved by Michael Dufresne, M.Sc., P.Geol., P.Geo., an independent qualified person (QP) as defined by National Instrument 43-101.

This news release contains data that is historical in nature and not verified by the Company*. Referenced nearby historic deposits and mines and projects provide geologic context for the Castilla Project and Cordillera Cobre Project, but are not necessarily indicative that they host similar potential, size or grades of mineralization. No mineral resources have been estimated at either the Castilla Project or Cordillera Cobre Project and there is no assurance that further work will result in a mineral resource classification.

|

*Scott Jobin-Bevans, 2024; National Instrument 43-101 Technical Report for the Buen Retiro Copper Project, Atacama Region III |

|

Copiapó Province and Copiapó Comuna Chile; unpublished Technical Report by Caracle Creek Chile SpA on behalf of Fitzroy Minerals Inc., 173p. |

The Canadian Securities Exchange has not reviewed this press release and does not accept responsibility for the adequacy or accuracy of this news release.

Forward-Looking Statements

This news release contains forward-looking statements and information within the meaning of applicable Canadian securities laws (collectively, “forward-looking statements”). These statements relate to future events or the Company’s future performance and reflect current expectations and assumptions. Forward-looking statements in this release include, but are not limited to: the successful completion of the acquisition of the Castilla Project; the anticipated exploration potential and geological characteristics of the Project; expectations regarding copper mineralization and metallurgical similarities to the nearby Manto Negro; the Project being valued by the market; the Company owning two complementary projects in Chile; the Company deploying a single exploration team and shared service contracts and reducing per-metre costs and accelerating decision timelines; the expected closing date of the acquisition; planned exploration activities and timelines; the potential economic value of the Project; anticipated benefits from logistical synergies between the Castilla and Cordillera Cobre projects; the Company’s ability to realize value from milestone-linked payments; the Company issuing a planned work programme update; and the overall strategy and growth plans of Super Copper.

Forward-looking statements are subject to various known and unknown risks, uncertainties, and other factors, many of which are beyond the Company’s control. These risks include, without limitation: the risk that exploration results may not confirm historical data or mineralization; the possibility that the Castilla Project does not host economically recoverable mineral resources; that milestone events triggering further payments may not occur; that permitting, financing, or development hurdles may delay or prevent advancement of the Project; that exploration costs may exceed expectations; that geological interpretations prove inaccurate; inability to secure permits, financing, or equipment; fluctuations in commodity prices and market demand; and regulatory or geopolitical developments in the jurisdictions where the Company operates; and risks generally associated with early-stage mineral exploration and development in Chile.

Although the Company believes the assumptions and expectations underlying forward-looking statements are reasonable, they should not be regarded as guarantees of future performance. The words “believe,” “expect,” “anticipate,” “plan,” “intend,” “may,” “will,” “estimate,” “potential,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these words.

Readers are cautioned not to place undue reliance on these statements. Super Copper disclaims any obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by applicable law.

Investors should refer to the Company’s continuous disclosure filings available on SEDAR+ for a full discussion of risk factors and uncertainties.

SOURCE Super Copper Corp.